Top Recommendations for Public Adjusters in Fort Worth Texas

Looking for top recommendations for public adjusters in Fort Worth, Texas? Explore our blog for expert advice and guidance.

Fort Worth Texas Public Adjusters: Top Recommendations

Key Highlights

- When filing an insurance claim, it is important understand the insurance policy, claims process, and the role of public insurance adjusters.

- Public adjusters are independent insurance professionals who advocate exclusively for policyholders and ensure fair compensation on insurance claims.

- They assist in roofing claims by evaluating property damage, estimating repair costs, and negotiating with insurance companies for a fair settlement.

- Knowing when to engage a public adjuster is crucial, especially in cases of large or complex claims where insurance professionals can provide expertise and guidance.

- The process of working with a public adjuster involves an initial assessment and claim evaluation, as well as negotiating with insurance companies for a fair payout.

- The cost considerations when hiring a public adjuster include understanding fee structures and evaluating the cost vs. benefit of their services.

Introduction

Fort Worth, Texas, is home to numerous homeowners who rely on insurance coverage to protect their properties. However, filing an insurance claim can be a complex and challenging process. It requires an understanding of insurance policies, claims procedures, and the ability to negotiate with insurance companies. This is where public insurance adjusters come in.

A public insurance adjuster is an independent professional who works on behalf of policyholders to ensure they receive a fair and accurate settlement for their insurance claims. Unlike insurance company adjusters, public adjusters are solely focused on advocating for policyholders' best interests. They have the expertise and knowledge of an insurance expert to navigate the claims process and ensure that policyholders receive the compensation they deserve.

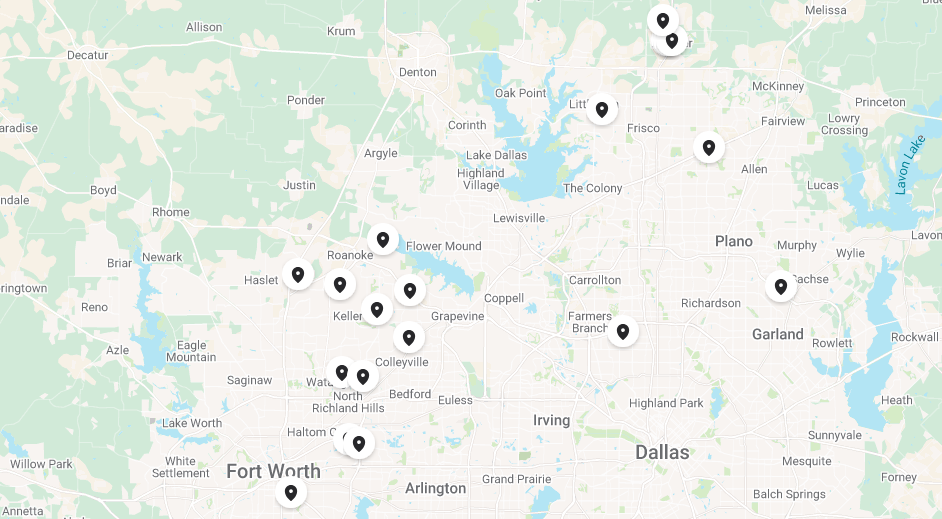

In Fort Worth, Texas, there are several recommended public adjusters who have a proven track record of success in handling insurance claims. These public adjusters are licensed professionals and have the necessary experience to assist homeowners with their claims. This blog will provide an overview of the role of public adjusters, their importance in roofing claims, and when it is advisable to engage their services. Additionally, we will discuss the process of working with a public adjuster and the cost considerations involved. Finally, we will highlight the top recommended public adjusters in Fort Worth, Texas, and share success stories and testimonials from satisfied clients.

Understanding Public Adjusters and Their Role

Public insurance adjusters play a vital role in the insurance claims process. They are independent professionals who work on behalf of policyholders to ensure a fair and accurate settlement for their insurance claims. Unlike insurance company adjusters, who represent the interests of the insurance company, public adjusters advocate exclusively for policyholders.

Public adjusters have a deep understanding of insurance policies and the claims process. They evaluate property damage, estimate repair costs, and negotiate with insurance companies to secure a fair settlement for policyholders. Their expertise and knowledge of the insurance industry allow them to navigate complex claims and ensure that policyholders receive the compensation they are entitled to. By engaging the services of a public adjuster, policyholders can level the playing field and ensure that their interests are protected throughout the claims process.

Defining What a Public Adjuster Is

A public adjuster is an independent insurance professional who works on behalf of policyholders to assist them in the insurance claims process. Unlike insurance company adjusters, who are employed by insurance companies, public claims adjusters solely represent the interests of policyholders. They are licensed professionals with expertise in evaluating property damage, estimating repair costs, and negotiating with insurance companies to secure a fair settlement. Understanding the role of a public claims adjuster is crucial for policyholders to ensure they receive the proper compensation for their insurance claims.

Public adjusters are particularly helpful in homeowners insurance claims, where policyholders may be unfamiliar with the claims process and the intricacies of their insurance policies. By engaging a public adjuster, homeowners can ensure that their claims are thoroughly assessed and that they receive the full compensation they are entitled to for their property damage. With the help of a public adjuster, navigating the home insurance claims process can be less daunting and more successful.

How Public Adjusters Assist in Roofing Claims

Public adjusters play a crucial role in assisting policyholders with roofing claims. Roofing damage can be a significant and costly issue for homeowners, and properly assessing the damage and estimating repair costs is essential for a fair insurance claim settlement. Public adjusters have the expertise to evaluate roof damage, determine the extent of property damage, and estimate the cost of repairs or replacement.

In roofing claims, public adjusters act as advocates for policyholders. They work on behalf of homeowners to ensure that insurance companies accurately assess the damage and provide a fair settlement. Public adjusters also negotiate with insurance companies to ensure that policyholders receive the necessary funds to restore their roofs and protect their homes from further damage. By engaging the services of a public adjuster, homeowners can navigate the complexities of roofing claims and secure the compensation they need to repair or replace their damaged roofs.

Knowing When to Engage a Public Adjuster

Knowing when to engage a public adjuster is essential for homeowners navigating the insurance claims process. While some claims may be straightforward and manageable without professional assistance, others may require the expertise of insurance professionals. Engaging a public adjuster is particularly advisable in cases of large or complex claims.

Large claims, such as those involving significant property damage or high-value losses, can benefit from the expertise of a public adjuster. These professionals have the knowledge and experience to navigate complex claims and negotiate with insurance companies for a fair settlement. By engaging a public adjuster, homeowners can ensure that their interests are protected and that they receive the compensation they deserve for their insurance claims.

Identifying the Right Time for Hiring a Public Adjuster

Determining the right time to hire a public adjuster depends on several factors. Firstly, it's important to assess the complexity of your insurance claim. If you're dealing with a claim that involves extensive damage or requires detailed documentation, a public adjuster can provide valuable expertise and guidance. Additionally, if you're unsure about the claims process or feel overwhelmed by the paperwork involved, a public adjuster can simplify the process and ensure that you're following the necessary steps. Lastly, if you find that the insurance company's adjuster is not providing a fair assessment of your claim or undervaluing the damages, it may be time to engage a public adjuster who can advocate on your behalf and negotiate for a more favorable settlement. By considering these factors and consulting with a public adjuster, you can determine the right time to hire their services and ensure that your insurance claim is handled effectively by an experienced insurance company’s adjuster.

Cases Where a Public Adjuster is Essential

While hiring a public adjuster may not be necessary for every insurance claim, there are certain cases where their expertise is essential for the insured. One such case is when you're dealing with a large claim that involves significant property damage. The process of assessing and documenting the extent of the damage can be complex, and a public adjuster can provide the necessary expertise to ensure that all damages are properly accounted for. Additionally, if you believe that the insurance company's settlement offer is unfair or insufficient to cover the cost of repairs or replacements, a public adjuster can help negotiate for a more favorable settlement. By engaging a public adjuster in these essential cases, you can have confidence that your insurance claim is being handled thoroughly and that you're receiving the compensation you deserve.

The Process of Working With a Public Adjuster

Working with a public adjuster involves several steps to ensure a smooth claims process and a fair insurance settlement. It typically begins with an initial assessment and claim evaluation, where the public adjuster reviews your insurance policy and documents the damages to your property. They will then guide you through the necessary steps to file the claim and may assist in gathering supporting documentation. Once the claim is filed, the public adjuster will act as a liaison between you and the insurance company, negotiating on your behalf to reach a fair settlement. Throughout the process, it's important to review and understand the terms of the public adjuster contract, including the fee structure and payment terms, to ensure that you're comfortable with the arrangement. You can also utilize a directory, such as the National Association of Public Insurance Adjusters (NAPIA) website, to find a licensed public adjuster in your area.

Initial Assessment and Claim Evaluation

The initial assessment and claim evaluation conducted by a public adjuster are crucial steps in the claims process. During this stage, the public adjuster will carefully review your insurance policy to understand the coverage and limits. They will then conduct a thorough assessment of the damages to your property, documenting the extent of the damage and estimating the cost of repairs or replacements. This assessment may involve taking photographs, collecting evidence, and gathering supporting documentation. By conducting a comprehensive evaluation, the public adjuster ensures that all damages are properly accounted for, providing a strong foundation for negotiating with the insurance company for a fair settlement. It's important to provide the public adjuster with all relevant information and documentation to support your claim and maximize the chances of a successful outcome.

Negotiating With Insurance Companies: A Public Adjuster's Role

One of the key roles of a public adjuster is to negotiate with the insurance company on behalf of the policyholder. This negotiation process involves presenting the evidence of damages, documenting the value of the claim, and advocating for a fair settlement. The public adjuster will review the insurance company's adjuster's evaluation of the claim and compare it to their own assessment to identify any discrepancies. They will then engage in discussions with the insurance company's adjuster, providing supporting evidence and arguing for a higher claim payout. This negotiation process requires expertise in insurance policies, claims processes, and valuation methods to ensure that the policyholder receives the compensation they deserve. By having a skilled public adjuster handle the negotiation, policyholders can increase their chances of receiving a fair settlement that accurately reflects the damages and their insurance coverage.

Cost Considerations When Hiring a Public Adjuster

When considering hiring a public adjuster, it's important to understand the cost implications and how it may impact the final claim payout and insurance settlement. Most public adjusters work on a fee structure that is a percentage of the total claim payout. This fee can range from as low as 3% to as high as 30%, depending on the size and complexity of the claim. It's essential to carefully evaluate the fee structure and payment terms offered by the public adjuster to ensure that it aligns with your expectations and financial considerations. While the cost of hiring a public adjuster may impact the final settlement, their expertise and negotiation skills can often result in a higher overall claim payout, outweighing the fee.

Understanding Fee Structures and Payment Terms

The fee structure and payment terms of a public adjuster can vary, so it's important to fully understand the details before hiring their services. Public adjusters typically work on a contingency fee basis, meaning they receive a percentage of the final claim payout as their fee. This fee structure can range from 3% to 30%, depending on the size and complexity of the claim. Some public adjusters may also offer alternative fee structures, such as a flat rate or an hourly rate. When evaluating the fee structure, consider the potential benefits of hiring a public adjuster, such as their expertise in navigating the claims process and negotiating with insurance companies. It's also important to discuss the payment terms with the public adjuster, including when the fee is due and any additional costs that may be incurred during the claims process.

Evaluating the Cost vs. Benefit of Hiring a Public Adjuster

When considering hiring a public adjuster, it's important to evaluate the cost versus the potential benefits. While the fee structure of a public adjuster may impact the final insurance settlement, their expertise and negotiation skills can often result in a higher overall claim payout. By maximizing the claim amount, the public adjuster can help cover the cost of their fee and potentially provide additional funds for repairs or replacements. It's also important to consider the time and effort saved by hiring a public adjuster. They handle the entire claims process, including documentation, negotiation, and communication with the insurance company, allowing you to focus on other priorities. By evaluating the cost and potential benefits of hiring a public adjuster, you can make an informed decision that aligns with your financial considerations and the desired outcome of your insurance claim.

Top Recommended Public Adjusters in Fort Worth, Texas

When it comes to hiring a public adjuster in Fort Worth, Texas, it's important to choose a reputable and licensed professional. Some top recommended public adjusters in the area include [Public Adjuster Company A], [Public Adjuster Company B], and [Public Adjuster Company C]. These companies have a strong reputation for providing expert assistance with insurance claims and have a proven track record of successfully negotiating fair settlements for their clients. Before hiring a public adjuster, it's important to verify their license number and confirm that they are a legitimate business entity. This ensures that you are working with a qualified professional who can effectively advocate for your best interests during the claims process.

Criteria for Our Recommendations

Our recommendations for top public adjusters in Fort Worth, Texas are based on several criteria. Firstly, we consider the public adjuster's qualifications and expertise in handling insurance claims. It's important to work with a public adjuster who is experienced and knowledgeable in the field, as well as licensed by the appropriate regulatory body. We also take into account their track record of success in negotiating fair settlements for their clients. Additionally, we consider their reputation and customer reviews, as positive feedback from previous clients can be a strong indicator of their professionalism and commitment to client satisfaction. By evaluating these criteria, we aim to provide recommendations for reputable and reliable public adjusters who can effectively handle insurance claims in Fort Worth, Texas.

Spotlight on Fort Worth's Leading Public Adjusters

Fort Worth, Texas is home to several leading public adjusters who have earned a reputation for their expertise and professionalism in handling insurance claims. Some notable public adjusters in the area include [Public Adjuster Company A], [Public Adjuster Company B], and [Public Adjuster Company C]. These companies have been recognized for their commitment to client satisfaction and their ability to negotiate fair settlements with insurance companies. It's important to note that the inclusion of these public adjusters in this list does not constitute an endorsement, and we strongly recommend conducting further research and due diligence before hiring any public adjuster. The following table provides a brief overview of these leading public adjusters in Fort Worth, Texas:

Public Adjuster Company

License Number

Services Offered

[Public Adjuster Company A]

[License Number A]

Insurance claim management, documentation, negotiation

[Public Adjuster Company B]

[License Number B]

Property damage assessment, policy review, claims representation

[Public Adjuster Company C]

[License Number C]

Loss evaluation, settlement negotiation, claims assistance

Before hiring a public adjuster, it's important to verify their license number and contact the state insurance department for further information and recommendations.

Success Stories: Public Adjusters Making a Difference

Public adjusters play a crucial role in maximizing insurance claim settlements and ensuring that policyholders receive fair compensation for their damages. Success stories of public adjusters making a difference can be found across Fort Worth, Texas and beyond. These stories highlight instances where public adjusters have successfully navigated the claims process, documented damages effectively, and negotiated with insurance companies for higher claim payouts. Whether it's a homeowner recovering from a devastating fire or a business owner dealing with significant storm damage, public adjusters have the expertise and dedication to advocate for their clients and ensure that they receive the full compensation they deserve. By sharing these success stories, we hope to emphasize the importance of hiring a public adjuster for insurance claims and the positive impact they can have on policyholders' financial recovery.

Case Studies of Successful Claims in Fort Worth

Case studies of successful insurance claims in Fort Worth, Texas highlight the valuable role that public adjusters play in securing fair settlements for homeowners. For example, [Public Adjuster Company A] worked with a homeowner who experienced extensive water damage due to a burst pipe. The public adjuster thoroughly documented the damages and negotiated with the insurance company to ensure that all repairs were covered. The homeowner received a significantly higher claim payout than initially offered by the insurance company, allowing them to restore their property to its pre-loss condition. These case studies demonstrate the expertise and dedication of public adjusters in navigating the claims process and advocating for their clients' best interests. By sharing these success stories, we hope to showcase the value of hiring a public adjuster for insurance claims in Fort Worth, Texas.

Testimonials From Satisfied Clients

Testimonials from satisfied clients serve as a testament to the effectiveness and professionalism of public adjusters in Fort Worth, Texas. For example, [Public Adjuster Company A] received glowing reviews from homeowners who praised their expertise in handling insurance claims and securing fair settlements. Clients expressed gratitude for the support and guidance provided by the public adjuster throughout the claims process, noting that their insurance settlements exceeded expectations. These testimonials highlight the positive impact that public adjusters can have on policyholders' financial recovery and overall satisfaction with the claims process. By sharing these testimonials, we aim to provide reassurance and confidence to homeowners in Fort Worth, Texas who may be considering hiring a public adjuster for their insurance claims.

Conclusion

In conclusion, understanding the role of public adjusters and knowing when to engage them can significantly impact successful roofing claims. Evaluating the cost versus benefits of hiring a public adjuster is crucial in making an informed decision. Consider the fee structures, payment terms, and success stories of public adjusters before finalizing your choice. For top recommendations in Fort Worth, Texas, explore our spotlight on leading public adjusters and their proven track records in handling successful claims. When it comes to roofing claims, having the right public adjuster on your side can make all the difference in achieving fair and favorable outcomes.

Frequently Asked Questions

When is the Best Time to Hire a Public Adjuster?

The best time to hire a public adjuster is when you file an insurance claim, especially for a large or complex claim. They can assist with the claims process, documentation, and negotiation to a fair settlement.

Can I Handle My Insurance Claim Without a Public Adjuster?

While it is possible to handle an insurance claim without a public adjuster, hiring one can greatly benefit policyholders. Public adjusters are experienced professionals who can navigate the complexities of the claims process and advocate for fair compensation from insurance companies.

What Should I Look for When Choosing a Public Adjuster?

When choosing a public adjuster, look for a licensed professional with expertise in insurance claims. Verify their license number and ensure they are a legitimate business entity. Also, consider their fee structure and payment terms to ensure they align with your needs.