How to Navigate Insurance Denials for Roofing Claims

Navigate Insurance Denials for Roofing Claims

Key Highlights

- Understanding the reasons behind insurance denials for roofing claims is crucial for homeowners.

- Familiarize yourself with common denial reasons such as inadequate documentation or pre-existing conditions.

- Learn the importance of thorough documentation, including photos, videos, and repair estimates, to support your claim.

- Discover the steps involved in requesting a reinspection and how a roofing contractor can assist you during the process.

- Explore alternative options like appraisals or involving a public adjuster if your claim is denied after reinspection.

Introduction

Dealing with roofing restoration problems is hard, but it gets tougher when insurance claims are turned down. Whether you need roofing services for your home or repairs for hail damage repair after a storm, it’s important to know how to handle insurance denials. This guide will help you learn the steps needed to get through these tough situations effectively.

Understanding Insurance Denials for Roofing Claims

Insurance denials for roofing claims can happen for many reasons. This can leave homeowners feeling upset and confused about what to do next. It is very important to know the exact reason for the denial before moving forward. Insurance companies have their own rules about what is covered and how much is included.

After you receive a denial, take time to read the insurance policy and the denial letter closely. This will help you find the specific reason for the denial. Common reasons include not having enough proof of damage, the damage not being covered in the policy, not keeping the roof in good shape, or mistakes in the claim details.

Common Reasons for Roofing Claim Denials

One main reason insurance companies deny roofing claims is not having enough proof of damage, including warranties or documentation. This often occurs after storms like hail or windstorms, where damage can be hard to see right away. It is important to keep good records. This should include clear photos and videos of the damaged areas taken during roof inspections.

Another reason for denial is if the damage is not included in the policy’s terms. Insurance policies usually list what they cover, like hail damage or storm damage.

However, damage from regular wear and tear, bad installation, or not taking care of the roof may not get covered. Also, mistakes in the claim details can lead to denials. If dates, damage descriptions, or past repairs are wrong, it can cause problems. Giving false or incomplete information can raise issues for insurance companies and put the claim at risk.

The Initial Steps to Take After a Denial

As a homeowner, getting a denial on your insurance claim can feel really frustrating. But don't give up hope. There are a few first steps you can take to handle this issue well. First, carefully read the denial letter along with your insurance policy. Look closely at the reasons given for the denial and any special rules that are included. Mark any points you disagree with or where you think there was a mistake.

After that, collect all important documents. This includes your insurance policy, the denial letter, any photos or videos of the damage, and any quotes for repairs. These papers will help back up your claim in future talks or appeals. If the denial happened because there isn’t enough proof, you might want to reach out for help from a skilled roofing contractor. A contractor can inspect your roof, write a full report about the damage, and give expert advice that could help your claim.

The Reinspection Process

If your first insurance claim for roof damage is denied, don't panic. A reinspection is a good chance to show more evidence and support your claim for coverage. During the reinspection, the insurance adjuster will come back to your property to look at the damage again. By knowing how the reinspection works and being ready for it, homeowners can improve their chances of a good result. This can help enhance energy efficiency and get the money needed to fix or replace their roofs, and address issues with their gutters.

How to Request a Reinspection

To start the reinspection process, you need to reply to the insurance company quickly. Formally ask them to review your claim again. In your request, describe why you think the first denial was wrong. Use your collected documents and give clear reasons.

Then, get qualified members of the roofing contractor to join during the reinspection. Their knowledge will help explain the damage clearly to the adjuster. Here are some tips for asking for a reinspection:

- Act Quickly: Reach out to your insurance company as soon as possible within the time limits in your policy.

- Be Thorough: Explain clearly what was wrong with the first denial and include your supporting documents.

- Involve Your Contractor: Ask that your roofing contractor be there to help argue for needed roof repairs or replacements.

What to Expect During a Reinspection

During a reinspection, the insurance adjuster will come back to your property. They will check the damage again and go over what they found before. It is very important to be there during this visit. Being present lets you answer any questions the adjuster might have. Having a reliable roofing contractor with you can help explain the damage and what roofing services are needed.

The adjuster will look at the roof closely. They will check for signs of covered issues and see how much damage there is. They may also look inside your home if they find signs of water damage or similar problems. The goal of the adjuster is to find out what caused the damage and how serious it is to decide what coverage is right for you.

Throughout this process, keep the lines of communication open with the adjuster about asphalt shingles. Be ready to give them any extra information or documentation they ask for. Work together with them, listen to their concerns, and make a strong case for why repairs or residential roofing craftsmanship replacements are necessary. This teamwork with the North Texas Roofing Contractors Association will help ensure customer satisfaction in the DFW area and the durability of your roof in Keller, Keller TX, Dallas TX. The North Texas Roofing Contractors Association plays a vital role in maintaining industry standards.

Exploring Your Options Post-Reinspection

Even after another inspection, there might be times when you and the insurance company disagree about your claim. If your claim is refused or if you think the settlement is too low, don’t be discouraged. You still have several options.

Think about these options carefully. Look at the benefits and costs to find the best choice for your case. Remember, you can ask for professional help. You can also explore all ways to get a fair outcome.

When to Consider an Appraisal

An appraisal can be a good way to solve problems about the value of your roofing project. It means hiring an independent appraiser to look at the damage. They will decide what a fair amount is for repairs or replacement. If your insurance company's estimate is very different from yours or your contractor's, starting an appraisal might be the best solution.

Remember, you and the insurance company usually split the cost of the appraisal. If the appraisal finds a much higher value for your claim, the insurance company might change its mind and give you a better offer. Before going ahead with an appraisal, check your policy or talk with your insurance agent to learn about the appraisal process and what you need to do.

It's also important to keep talking openly with your insurance company during this time. Make sure to give them a copy of the appraisal report when it is ready. The report's findings and your ongoing communication can help you get a fair resolution and a smoother payment schedule for your roofing project.

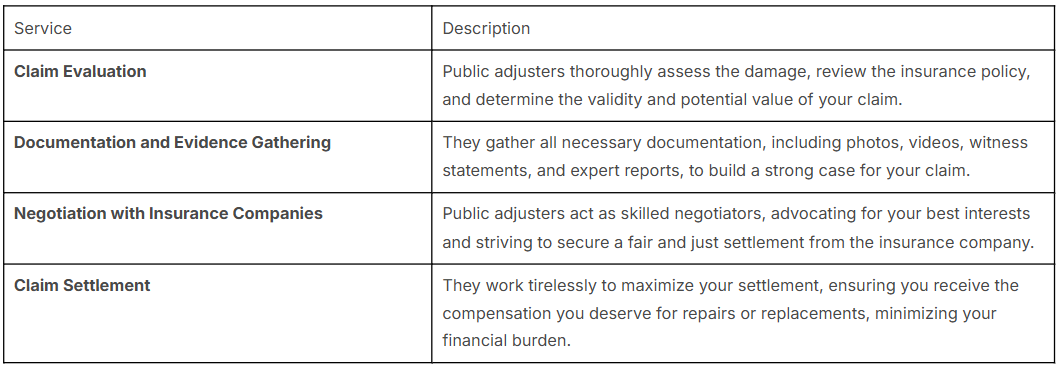

The Role of a Public Adjuster

A public adjuster can be an invaluable asset when navigating complex insurance claims, especially for denied roofing claims. Unlike insurance adjusters who work for the insurance company, public adjusters work exclusively for the policyholder, representing their best interests throughout the claim process.

Public adjusters bring years of experience and expertise in the roofing industry, including insights from a Keller roofing company and roofer, possessing a deep understanding of insurance policies, construction costs, and negotiation tactics, as well as offering a wide range of roofing services, including new roof installations. They level the playing field by providing homeowners with expert guidance and support, ensuring their rights are protected throughout the process.

Legal Actions and Attorney Involvement

Most roofing insurance claim disputes get solved through talks, checks, or appraisals. However, sometimes you might need to take legal action. If you have tried everything else and feel you have a solid case, it’s a good idea to talk to an attorney who knows insurance law.

An attorney can look at the details of your case. They will tell you about your rights and guide you through the hard parts of going to court if needed. They can help you make a strong legal case, find evidence, and represent you well in court.

Circumstances That Warrant Hiring an Attorney

While most roofing insurance claims get handled without lawyers, there are times when you might need one. For example, if you think your insurance company is being unfair, like taking too long or denying your claim without a good reason, it may be a good idea to get legal help.

Another time you should think about hiring a lawyer is if you lose a lot of money because your claim was denied. If the damage to your roof is serious and you face high costs for repairs or replacement, an attorney can assist you in getting the money you deserve by using the legal system.

Lastly, if you feel confused and stressed about the insurance claim process, getting a lawyer can help you feel better and clearer. A lawyer who knows insurance law can explain your rights as a homeowner, check how strong your case is, and help you choose the best steps to take.

Navigating the Legal Process

Navigating the legal process can be tough and confusing. It requires learning about legal steps, collecting evidence, and standing up for your rights. With the right lawyer and a good understanding of the process, you can improve your chances of getting a good result. The first step is to talk to a lawyer who is skilled in insurance claim cases. They will look at your situation closely, check the strengths of your claim, and help you decide what to do next. This meeting helps create a strong bond between you and your lawyer based on trust and clear communication.

During the legal process, being organized and keeping good records is very important. Always write down details of all talks, like emails, letters, and phone calls, with the insurance company and others involved. Keep copies of all papers related to your claim, including your insurance policy, the letter of denial, repair costs, and any messages exchanged about the claim.

Conclusion

Navigating insurance denials for roofing claims can be tricky. However, if you know what to do, you can get through it. First, understand why claims are often denied. Also, learn about the reinspection process. You might want to ask for a reinspection or bring in a public adjuster to help you. In some cases, legal action may be needed. It is important to keep trying if your claim is denied. If you're having trouble with your roofing claim denial, get professional advice to see all your options for fixing the issue. Stay informed and proactive. Don't be afraid to consult experts for help in managing insurance denials well.

Frequently Asked Questions

How do I request a reinspection for my roofing claim?

To ask for a reinspection, homeowners need to write to their insurance company and explain why. It's important to share clear documents, like photos and videos of the damage. You might also want to have your roofing contractor there during the reinspection. This can help get a fair look at the insurance claim.

Can a public adjuster increase my chances of claim approval?

Public adjusters cannot promise that your claim will be approved. However, their hard work, dedication, and skill in the roofing industry can be very helpful. They use their knowledge to guide you through the insurance claim process. They will stand up for your best interests. Their goal is to increase your chances of a good result and boost customer satisfaction.

When should I consider hiring an attorney for a denied roofing claim?

- Think about hiring a lawyer if your insurance company is not acting fairly.

- Consider it if they offer you a very low settlement.

- Also, if you are going through serious money issues because of a denied claim.

- A lawyer can help homeowners understand the legal process.

- They can also protect their rights.

What are common reasons for insurance denials on roofing claims?

Common reasons people get denied include not having enough proof of damage. This can happen if there is no evidence of hail damage or storm damage. Other reasons include problems that existed before the event, not taking care of the property properly, or mistakes in the insurance claim information. It is very important to clearly document the damage and give accurate information to the insurance company.

How long does the insurance reinspection process take?

The timeline for reinspection can change based on how busy the insurance company is and how complicated your claim is. Usually, you should expect the reinspection to take a few weeks. During this period, the insurance company checks the findings. They might also talk to experts if needed. After this, they decide on coverage for the repairs. This helps make sure your roof is strong, especially if it involves metal roofing, and allows for the best roofing services.

Our Location

Hours

Hours

Contact Us

License # 03-0235