Deadline to File a Hail Damage Claim and Prep Tips for Fort Worth Commercial Roofing Inspections

This is a subtitle for your new post

Timing & Tidying: Deadline to File a Hail Damage Claim and Prep Tips for Fort Worth Commercial Roofing Inspections

In the face of hail damage, knowing “how long do you have to file an insurance claim on a property for hail damage is important. Fort Worth business owners typically have a one-year period to file, although it’s best not to delay. This definitive guide will navigate you through the critical pre-inspection steps to take, ensuring you maximize your claim. Whether it’s cleaning up debris or temporary fixes, we’ve got you covered along with professional insights from Fort Worth commercial roofing experts at Becker Roofing and Exteriors.

Key Takeaways

- The typical deadline to file a hail damage insurance claim is one year from the date of the storm, but exceptions can extend this period depending on the insurance policy and state regulations.

- Immediate action is generally advised in filing a hail damage claim, as delays can complicate the claims process, lead to denial of the claim, and potentially incur additional costs.

- Before an insurance adjuster evaluates hail damage, it’s important to secure the property to prevent further damage, document the extent of damage meticulously, and refrain from full repairs until after the assessment.

Understanding the Filing Deadline for Hail Damage Claims

Knowing when to file a hail damage insurance claim is crucial if your property has been hit by a hail storm. Most companies provide a one-year window from the date of the hailstorm occurrence for you to submit your insurance claim. However, the time frame can vary, with some companies allowing as short as 30 days and others up to two years.

Yet, the standard one-year deadline can have exceptions. If your insurer is not prejudiced by the late notice of the claim and if the policy and state regulations permit a longer filing period, you could potentially have more time to file your claim. Requesting an extension on the filing deadline is also an option. This should be done in writing, at least a month before the deadline, and specify a time frame for the insurer to respond.

The Standard One-Year Window

The standard one-year window for filing a hail damage claim is common among most insurance companies. This deadline exists to facilitate efficient claim handling and fraud prevention by ensuring timely claim filing. Nevertheless, filing a claim after the one-year deadline could have consequences for the policyholder, such as inability to challenge a claim denial or receive their depreciation payment, leading to potential financial losses.

In certain circumstances, a claim may be permitted after the standard one-year filing window, such as if the property was previously damaged in a hail storm and the damage was not repaired before another storm occurred.

Exceptions to the Rule

Under certain circumstances, such as when the policy includes an automatic extended reporting period (ERP) extension for 30 to 60 days, insurance companies might extend the filing period up to two years. On the other hand, in Texas, the typical statute of limitations for filing a hail damage claim on a homeowner’s insurance policy is two years from the date of the storm or when the damage occurred. Some policies may even require filing within 60 or 90 days after the damage was sustained. It’s always advisable to review your policy documents or get in touch with your insurance agent to discover your company’s policy exceptions for hail damage claim filing deadlines.

Requesting Extensions

In case you cannot file your claim within the allotted time for any reason, an extension request is an option. To do this, follow these steps:

- Send an email to your insurance company with the subject line ‘Claim # [enter your claim number here] Extension Request’.

- Clearly state your request for an extension and provide a valid reason for needing it.

- Your extension request should contain specific details such as the cause of the loss, proof of ownership, and estimates for the repairs.

Some policies may permit multiple requests for extensions when filing hail damage claims. However, a denied extension may result in the claim being filed beyond the deadline and subsequently rejected by the insurance company, which can have an adverse effect on your insurance score.

To Wait or Not to Wait: Assessing the Best Time to File Your Claim

After understanding the filing deadline and potential extensions, your next decision should be on when to file your claim. You might be tempted to file your claim immediately after the storm, but it’s important to assess the best time to do so. Filing a claim too long after the hail damage occurred may lead to denial by insurance companies, so taking immediate action is generally advisable.

However, it’s also important to consider the severity of the hail damage. Minor damage may not necessitate a claim, and in some cases, the full extent of hail damage may only become apparent over time.

Immediate Action vs. Delayed Filing

Submitting a claim without delay can facilitate proof of hail damage and speed up repairs. Yet, prolonged waiting can cause additional damage and complications. Delayed or late reporting of hail damage can lead to denial of claims, as insurance policies and state laws usually mandate timely processing and reporting of such incidents to prevent unwarranted delays.

As such, promptly contacting your insurer and a contractor can hasten the repair process.

Consequences of Postponement

Postponing a claim could lead to extra costs, rejected coverage, or higher premiums. If you delay your claim, you could face intentional delays in inspections or payment for repairs by insurance companies, possibly leading to out-of-pocket expenses. Moreover, prolonged delay may give insurers the chance to deny the claim, asserting that the damage is unrelated to the hail event.

Postponing the filing of a hail damage claim can also result in additional financial hardships, such as having to cover a significant sum for repairs due to escalated damage to your property, like the emergence of leaks, mold growth, and structural issues. However, it’s worth noting that the delayed filing of a hail damage claim does not result in higher premiums as hail damage is categorized as an ‘Act of Nature’ and is not perceived to be within the policyholder’s control.

Pre-Claim Property Care: Steps to Take Before the Insurance Adjuster Arrives

Before the arrival of the insurance adjuster to evaluate the damage, you should undertake several measures to safeguard your property and avert further damage. These include:

- Removing dead wood from trees

- Securing loose items like patio furniture

- Ensuring the closure and security of windows and doors

- Parking vehicles in a garage or under shelter

- Trimming trees and shrubs to prevent branch breakage

- Inspecting and repairing the roof

- Potentially reinforcing the roof with impact-resistant materials

It is also crucial to document the damage before initiating any cleanup. Well-documented damage is essential in ensuring fair compensation for the property damage sustained.

When it comes to cleaning up after a hail storm, safety should be your priority. Prioritize the safe removal of hazards and securing the property. This involves trimming trees, securing loose items, using tarps to cover exposed areas, and making temporary fixes such as patching up broken windows. Refrain from undertaking full repairs until after the insurance adjuster’s evaluation.

Securing the Site

Following a hail storm, implementing protective measures to prevent additional damage to your property is essential. This includes:

- Ensuring the roof is in good condition

- Anchoring or storing patio furniture

- Using impact-resistant materials for the roof

- Trimming trees to remove dead branches

- Securing loose items

- Closing curtains or blinds.

The most suitable materials for covering exposed areas after hail damage include composite roofing, rubber roofs, rubberized shingles, and metal roofing. If you fail to promptly secure a site that has been damaged by hail, this can lead to serious consequences, including property damage, interruption of business operations, increased risk of bodily injury claims, rusting of vehicles, and damage to roofs, gutters, siding, and windows. Additionally, there is a risk of experiencing leaks, mold growth, and structural issues.

The best practices for securing a hail damaged site include:

- Removing dead wood from trees

- Securing outdoor items

- Considering impact-resistant roofing materials

- Weatherstripping windows and doors

- Replacing cracked or broken windows

- Protecting outdoor furniture

- Ensuring a sturdy roof

- Utilizing roof underlayment

- Arranging for professional repairs.

Documenting the Damage

For insurance claims, a thorough inspection of all property areas, including roofs and windows, is vital while documenting hail damage. Carefully photograph or video record all damage, measure dents and cracks, and promptly include comprehensive details of the damage in the claim. This meticulous evidence is vital for substantiating the claim.

The types of photos to be taken when documenting hail damage for an insurance claim should present the comprehensive view of your property and also focus on the specific areas of damage. This should encompass both external and internal damage.

Key errors to avoid when documenting hail damage for insurance claims include:

- Neglecting immediate inspection

- Delaying the insurance claim

- Not hiring a professional

- Overlooking hidden damages

- Rushing repairs

- Waiting too long to file a claim

- Insufficient documentation

- Not filing a claim with an insurance company

- Waiting to contact the insurance company

- Being blindsided by the deductible

- Accepting a settlement check

- Not communicating clearly.

Cleanup Considerations

Following the securement of the site and damage documentation, the cleanup process can be initiated. This should focus on safety and preventing further damage, rather than making repairs. Efforts should be directed towards addressing roof and window damage, salvaging exposed items, and implementing temporary repairs such as tarping the roof or boarding up windows. The primary focus should be on ensuring safety and mitigating damage, rather than permanent repairs.

When dealing with hail damage, it’s important to consider the specific methods for each type of item. Here are some approaches to consider:

- For cars, paintless dent repair is a widely used and effective approach.

- Windows and doors need to be meticulously inspected for any signs of cracks or dents.

- Roof damage necessitates an immediate assessment, proper documentation for insurance claims, and timely notification to the insurance company.

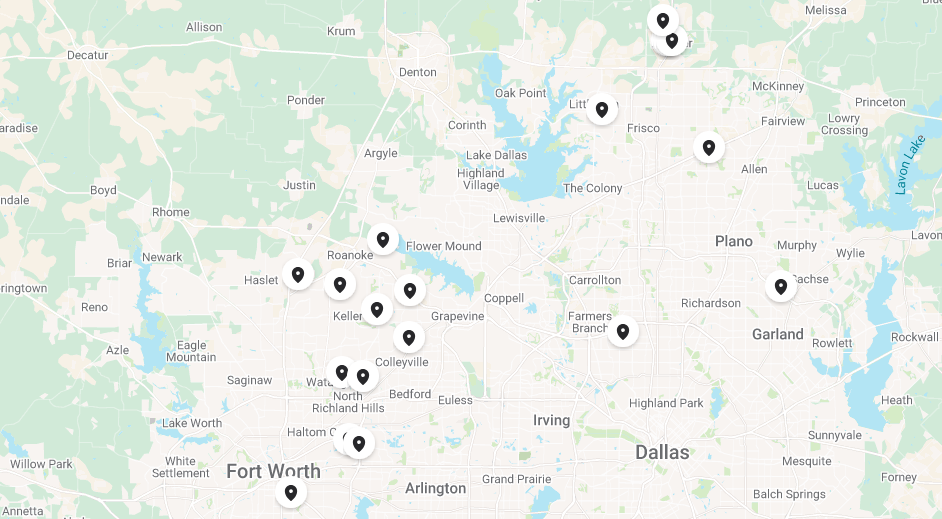

Partnering with Fort Worth Roofing Experts

Collaborating with local Fort Worth roofing experts can offer significant benefits during the claims process. These experts can:

- Assess damage

- Analyze storm damage

- Document the damage for insurance claims

- Facilitate the claims process

Their experience and expertise can help identify and resolve roof issues, preventing expensive water damage and ensuring a seamless claims process through a free no obligation inspection.

A roofing contractor in Fort Worth is considered an expert by fulfilling the licensing requirements established by the state of Texas and acquiring professional certifications in specialized areas such as storm damage repair and roof inspection. This makes them a reliable roofing company in the region.

Why Choose Local Expertise

Choosing local expertise is crucial when it comes to dealing with hail damage. Local roofing professionals in Fort Worth have:

- extensive knowledge and skills in repairing damaged roofs and gutters

- a deep understanding of local architectural styles and weather conditions

- local expertise in building codes and weather patterns

This enables professionals to perform comprehensive and precise hail damage repairs that adhere to the necessary standards and are appropriate for the particular climate conditions.

Comprehending local weather patterns is significant for hail damage assessment and repair as it enables insurers and professionals to:

- Gain insights into the frequency, severity, and geographical distribution of hailstorms

- Facilitate the prediction of hail risks

- Assess the extent of damage

This information is crucial for effectively managing and mitigating hail-related risks.

Coordinating with Your Roofer

Once you’ve identified a reputable local roofing expert, it’s important to coordinate with them throughout the claims process. A roofer plays a crucial role in obtaining estimates for insurance claims by:

- Offering their professional estimate of the repair costs

- Meticulously documenting the roof repair

- Preparing detailed itemized estimates for all work carried out

- Ensuring the accuracy of insurance claim paperwork

Moreover, the presence of a roofer during adjuster meetings is significant because they can:

- Assist the adjuster

- Provide expertise and guidance

- Ensure that all damages are properly assessed and documented

- Prevent any damage from being overlooked or underestimated.

Navigating the Insurance Claims Process: A Step-by-Step Guide

After securing your property, documenting the damage, and joining forces with a local roofing expert, the subsequent step is to work your way through the insurance claims process. The initial procedures to follow when commencing a hail damage insurance claim are to meticulously document the hail damage and conscientiously review your insurance policy to comprehend the coverage available for your situation.

To support your claim, you need to provide specific documentation such as photographs depicting the hail damage. Your insurance company will then determine the payment amount for your claim by taking into account the severity of the damage, the expenses associated with essential repairs, and the details of your policy coverage.

Initiating the Claim

Kick off your claim by thoroughly documenting the damage, filing a claim with your insurance company, and setting up a meeting with an insurance adjuster. When reporting hail damage, it’s essential to provide the type of coverage you have, details about the damage, and supporting documentation such as photos or videos.

After documenting the damage, file an insurance claim with your insurance company and subsequently arrange a meeting with an insurance adjuster for further assessment.

Working with the Insurance Adjuster

Collaborating with an insurance adjuster constitutes a critical aspect of the claims process. The responsibilities of an insurance adjuster in a hail damage claim include gathering evidence of hail damage, assessing the property’s damage, and determining the payout for the claim.

Effective communication with insurance adjusters is crucial to ensure a smooth claims process. Here are some tips to help you communicate effectively:

- Confirm the adjuster’s identity.

- Meticulously document all communication.

- Refrain from hasty settlements.

- Actively ask questions.

- Demonstrate organization and preparedness.

By following these tips, you can improve your communication with insurance adjusters and increase the chances of a successful insurance process, particularly during the claims process.

Finalizing Repairs and Payment

Post-claim approval, your next move should be to finalize the repair plans and sort out payment arrangements. Once you’ve received approval for your claim, select a reputable, licensed, and insured contractor to carry out the repairs. Obtain a thorough estimate for the repairs and submit it to the adjuster for review.

The process for insurance payments involves filing a claim with your insurance provider, paying the policy deductible, and then the insurer will pay for the repairs. Typically, it takes around 30 days for an insurance company to settle a hail damage claim. However, a straightforward physical-damage claim can be resolved within one to two weeks.

Maximizing Your Claim: Tips and Strategies

Understanding your policy, securing multiple estimates, and keeping detailed records are key to maximizing your hail damage claim. When examining your insurance policy regarding claims for hail damage, focus on the process of filing a claim, which includes contacting the insurance company and providing documentation such as notes and photographs of the damage.

It’s also important to consider the severity of the hail damage when determining whether to file a claim.

Understanding Your Policy

Comprehension of your insurance policy is vital when lodging a hail damage claim. A standard hail damage insurance policy includes coverage for hail damage to vehicles and homes. The coverage limits in hail damage insurance policies establish the uppermost sum that the insurer will compensate for the damage, subtracting the deductible.

The deductible in a hail damage insurance policy is typically calculated as a percentage of the damage costs, commonly falling within the range of 1% to 5%. However, there can be exclusions in a hail damage insurance policy, such as cosmetic damage, which can potentially reduce your claim payout.

Getting Multiple Estimates

Securing multiple estimates is vital for several reasons:

- It allows you to compare contractor and insurance evaluations

- It assures top-notch workmanship

- It helps you avert unforeseen out-of-pocket costs

- It can possibly speed up the repair process

With the cost of hail damage repairs ranging from $3,000 to $10,000, having several price points can help you make a more informed decision.

Key factors to consider when comparing repair estimates include the size and scope of the project, the specific type of roofing material needed, and what is covered by your insurance policy.

The Importance of Record-Keeping

Maintaining meticulous records is a key component of lodging a hail damage claim. Here are some crucial steps in documenting your claim:

- Meticulously capture photographs of the damage from various perspectives.

- Meticulously record the state of the home internally and externally.

- Compile a detailed inventory of the damage.

- Gather all repair estimates.

By following these steps, you can ensure that you have all the necessary documentation for your hail damage claim.

Precisely recording the damage through multiple photos or videos from different perspectives and maintaining a written log of events can facilitate a successful claim processing.

Summary

In conclusion, when a hailstorm hits, it’s vital to understand the process of filing a hail damage claim. From understanding the filing deadline and assessing the best time to file your claim, to securing your property, documenting the damage, partnering with local roofing experts, navigating the insurance claims process and finally, maximizing your claim. Understanding these steps can help you navigate the process smoothly and successfully.

Frequently Asked Questions

How do you negotiate hail damage claim?

When negotiating a hail damage claim, gather evidence, take proactive measures, be prepared for the assessment, refuse to give a recorded statement, anticipate negotiations, and consider seeking legal counsel to help with the process.

How long do I have to report hail damage in Texas?

You have up to two years from the date of the hailstorm to report hail damage in Texas. It's important to report the damage within this time frame to ensure your claim is still valid.

Does hail damage affect home insurance premiums?

Yes, hail damage can lead to an increase in your home insurance premiums due to the filing of a claim for the damage. Therefore, it's important to consider the potential impact on your rates before filing a claim for hail damage.

What is the standard deadline for filing a hail damage claim?

You should file a hail damage claim within one year from the storm or incident date, but check with your insurance company as they may have different deadlines.

What steps should I take to secure my property after a hail storm?

After a hail storm, take steps to secure your property by removing dead wood from trees, securing loose items, ensuring the closure and security of windows and doors, and potentially reinforcing the roof with impact-resistant materials. These measures can help prevent further damage.