Avoid These Insurance Companies for Roof Repairs in Texas

A clear of the worst insurance companies for roof replacement claims in Fort Worth Texas. Discover which companies to avoid in our latest blog post.

Avoid These Insurance Companies for Roof Repairs in Texas

Key Highlights

- It is important to be cautious when choosing insurance companies for roof repairs in Texas, as some may engage in bad faith practices.

- Homeowners should be aware of the claims process and understand their homeowner's insurance policy before filing a roof repair claim.

- The insurance companies to avoid for roof repairs in Texas include The Notorious Delay and Deny Insurance Corp, Lowball Settlements Insurance Group, The Never-Ending Paperwork Insurers, Premium Hikes & Claims Rejection Associates, and Storm Damage Dismissal Ltd.

- Choosing the wrong insurance company can have serious consequences, including financial strains, stress and anxiety, and a decline in property value.

- Homeowners should watch out for red flags before it's too late, such as alarmingly low quotes, negative reviews and complaints, and policy exclusions in the fine print.

Introduction

Filing an insurance claim for roof damage in Fort Worth, Texas can be a challenging and daunting process. It is essential to have the right knowledge and guidance to navigate through the claims process successfully. While hiring a trusted local contractor can be beneficial, it is equally important to choose the right insurance company for roof repairs.

Insurance companies play a crucial role in the claims process, as they are responsible for assessing the damage, approving the necessary repairs, and providing the appropriate financial coverage. However, not all insurance companies are reliable and trustworthy when it comes to roof repairs. Some insurance companies engage in bad faith practices, delaying or denying valid claims, offering lowball settlements, and creating unnecessary paperwork burdens for homeowners.

In this blog, we will highlight the insurance companies to avoid for roof repairs in Texas and discuss the potential consequences of choosing the wrong insurance company. We will also provide tips on how to identify red flags before it's too late and offer guidance on the steps to take after storm damage to ensure a successful insurance claim for roof repairs. By being informed and proactive, homeowners can protect their rights and secure the necessary coverage for their roof repairs.

Insurance Companies to Avoid for Roof Repairs in Texas

When it comes to roof repairs in Texas, there are some insurance companies that homeowners should avoid due to their bad faith practices. These companies often delay or deny valid insurance claims, leaving homeowners in a difficult situation. Dealing with these companies can result in unnecessary stress, financial strain, and a lack of proper repair for the roof damage. It is important for property owners to be aware of these companies and seek out reputable insurance providers that prioritize their customers' needs.

1. The Notorious Delay and Deny Insurance Corp

One insurance company to avoid for roof repairs in Texas is The Notorious Delay and Deny Insurance Corp. This company has gained a reputation for intentionally delaying or denying valid insurance claims, particularly for hail damage. Their goal is to frustrate policyholders and make the entire claims process as difficult as possible. However, Texas law protects homeowners from such bad faith practices. According to the Texas Insurance Code, if an insurance company acts in bad faith, the policyholder may be entitled to punitive damages. It is crucial for homeowners to be aware of their rights and seek legal assistance if they encounter such tactics from insurance companies.

2. Lowball Settlements Insurance Group

Lowball Settlements Insurance Group is another insurance company that homeowners should avoid for roof repairs in Texas. This company is known for offering unreasonably low settlements for insurance claims, particularly for water damage. They often undervalue the extent of the damage and fail to adequately compensate homeowners for the repair costs. It is important for homeowners to carefully review their insurance policy's terms and coverage to ensure they are not being taken advantage of by such bad faith insurance companies. Seeking legal guidance can help homeowners understand their rights and fight for fair compensation for their roof repairs.

3. The Never-Ending Paperwork Insurers

The Never-Ending Paperwork Insurers are insurance companies that create unnecessary paperwork burdens for homeowners filing roof repair claims. They often require extensive documentation and multiple rounds of paperwork, leading to delays and frustration for homeowners. Dealing with these insurers can be time-consuming and overwhelming, especially for homeowners who are already dealing with the stress of property damage. In such cases, it is advisable for homeowners to seek assistance from a law firm specializing in insurance claims. A free consultation with a legal expert can help homeowners understand their rights and streamline the claims process, saving them time and ensuring fair treatment.

4. Premium Hikes & Claims Rejection Associates

Premium Hikes & Claims Rejection Associates is an insurance company that homeowners should avoid for roof repairs in Texas. They are known for raising homeowners' insurance premiums significantly after a claim is filed, making it financially burdensome for homeowners to continue coverage. Additionally, this company often rejects valid claims for wind damage, leaving homeowners to bear the cost of repairs themselves. It is important for homeowners to carefully review their insurance policies and understand the coverage for wind damage before choosing an insurance provider. Seeking alternative insurance options can help homeowners avoid excessive premium hikes and ensure proper coverage for roof repairs.

5. Storm Damage Dismissal Ltd.

Storm Damage Dismissal Ltd. is an insurance company that homeowners should be cautious of when it comes to roof repairs in Texas. This company often dismisses valid roof damage claims, particularly after severe weather events. They employ sneaky tactics and find loopholes in the policy to avoid providing coverage for necessary repairs. Homeowners should be aware of these practices and thoroughly review their insurance policies, especially the section on roofing materials, to ensure they are properly covered. Seeking legal advice can help homeowners navigate the claims process and protect their rights when dealing with Storm Damage Dismissal Ltd. or similar insurance companies.

Understanding the Consequences of Choosing the Wrong Insurance

Choosing the wrong insurance company for roof repairs in Texas can have severe consequences for homeowners. From delays and denials of legitimate claims to offering lowball settlements, these actions can lead to financial strains, stress, and anxiety for homeowners. Additionally, inadequate repairs and lack of proper coverage can result in a decline in property value. It is crucial for homeowners to thoroughly research and choose a reputable insurance provider that prioritizes their needs and provides fair and prompt coverage for roof damage.

Financial Strains: The High Cost of Inadequate Coverage

One of the consequences of choosing the wrong insurance company for roof repairs in Texas is the financial strain it can cause for homeowners. Inadequate coverage and lowball settlements can leave homeowners with significant out-of-pocket expenses for repairs. The entire process of filing an insurance claim can be time-consuming and costly, especially if the insurance company drags their feet or denies valid claims. This can put a strain on homeowners' finances and make it difficult to afford the necessary repairs for their damaged roof. It is important for homeowners to choose an insurance company that provides fair and comprehensive coverage to avoid such financial strains.

Stress and Anxiety: Navigating the Claims Maze

Another consequence of choosing the wrong insurance company for roof repairs in Texas is the stress and anxiety that homeowners may experience during the claims process. Dealing with delays, denials, and complex insurance policies can be overwhelming and frustrating. Homeowners may feel powerless and uncertain about the outcome of their claim. It is important for homeowners to choose an insurance company that has a straightforward claims process, clear communication, and policies that are easy to understand. This can help alleviate stress and anxiety during the claims process and ensure homeowners receive the coverage they deserve for their roof repairs.

Property Value Decline: Long-Term Effects of Unrepaired Damage

Choosing the wrong insurance company for roof repairs in Texas can have long-term consequences on the value of a property. If roof damage is left unrepaired or inadequately repaired due to an insurance company's actions, it can lead to further property damage and a decline in value. Additionally, if an insurance company acts in bad faith by delaying or denying valid claims, homeowners may be entitled to punitive damages under the Texas Insurance Code. It is important for homeowners to choose an insurance company that prioritizes prompt and fair coverage for roof repairs to avoid these long-term effects on property value.

Identifying Red Flags Before It's Too Late

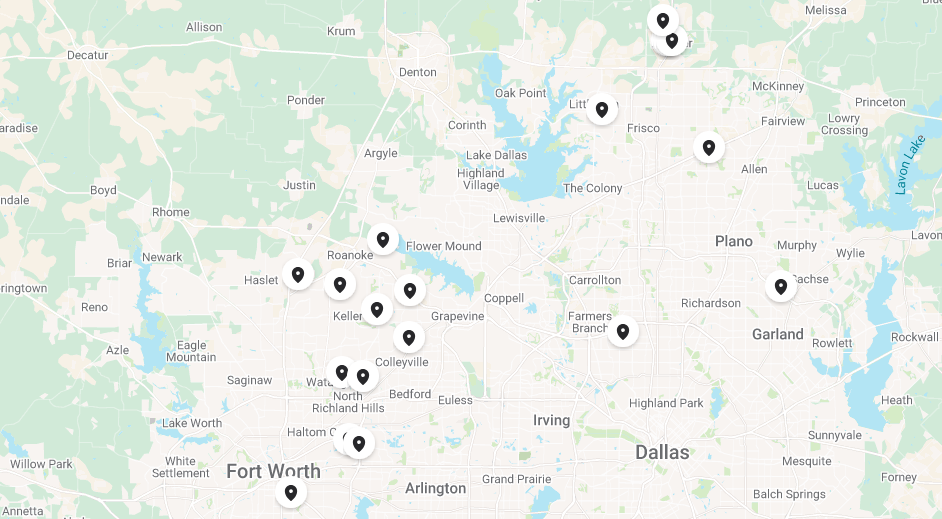

To avoid the consequences of choosing the wrong insurance company for roof repairs in Texas, homeowners should be vigilant in identifying red flags before it's too late. These red flags can include alarmingly low quotes, negative reviews and complaints, and policy exclusions hidden in the fine print. Homeowners in Fort Worth should be especially cautious, as this area is prone to hail damage and severe weather. By being aware of these red flags and seeking alternative insurance options, homeowners can protect themselves from bad faith insurance practices and ensure proper coverage for their roof repairs.

Alarmingly Low Quotes: Too Good to Be True

One red flag to watch out for when choosing an insurance company for roof repairs in Texas is alarmingly low quotes. If a quote seems too good to be true, it often is. Some insurance companies may offer low quotes to attract customers, but these lowball offers may not provide adequate coverage for roof repairs. It is important for homeowners to thoroughly review the terms and conditions of the insurance policy and consider seeking guidance from a law firm specializing in insurance claims. A free consultation with a legal expert can help homeowners understand the true cost and consequences of choosing a low quote for roof insurance.

Negative Reviews and Complaints: The Warning Signs Online

Another red flag to watch out for when choosing an insurance company for roof repairs in Texas is negative reviews and complaints. Online reviews can provide valuable insights into the experiences of other homeowners who have dealt with a particular insurance company. Pay attention to reviews that mention issues with coverage for roof repairs, delays in claim processing, or denials of valid claims. Additionally, consider seeking recommendations from friends, family, or trusted contractors in the Fort Worth area who have had positive experiences with insurance companies. These warning signs can help homeowners avoid insurance companies that are not responsive or reliable when it comes to roof repairs.

Fine Print Fiascos: Policy Exclusions That Hurt

Homeowners often overlook policy exclusions, leading to unwelcome surprises during insurance claims. Understanding the fine print is crucial to avoid disappointments. Some policies might exclude specific types of damage or limit coverage under certain circumstances. For example, damage from poor maintenance or wear and tear might not be covered. It's vital to carefully review what your policy covers and its limitations to prevent being caught off guard when filing a claim. Simultaneously, seek clarification from your insurer on any unclear or ambiguous terms.

Taking Action: Steps After Storm Damage

Immediate action post-storm damage is crucial. Document the damage for your insurance claim. Get professional assessments to substantiate your claim. Understand the claims process thoroughly to navigate it smoothly.

Immediate Documentation: Protecting Your Claim

After experiencing roof damage, promptly document all issues by taking photos and videos. Receipts for temporary repairs and communication records with the insurance company are crucial. Swift action can strengthen your claim by providing clear evidence of the damage. It's wise to keep a detailed record of all conversations and transactions related to the claim. Immediate documentation is key to protecting your rights and ensuring a smoother claims process. Don't delay in safeguarding your claim with a thorough paper trail.

Seeking Expert Opinions: Why Professional Assessments Matter

Seeking expert opinions for roof damage claims is crucial as professional assessments carry significant weight in insurance processes. Professionals, like roofing contractors or loss adjusters, provide detailed reports on the extent of damage, which can influence claim outcomes. Their expertise ensures accurate evaluations, helping property owners navigate insurance complexities effectively. By involving experts, homeowners can avoid undervalued claims and ensure proper repairs are made. Trusting in professional advice can lead to fairer settlements and smoother claim resolutions, providing peace of mind in challenging situations.

Navigating the Claims Process: A Step-by-Step Guide

Navigating the claims process starts with reporting the damage promptly to your insurance company. Document all communication and keep records of every interaction. Ensure your claim includes all relevant details and supporting documentation. Follow up regularly with your insurer for updates on your claim status. If needed, seek guidance from a legal team specializing in insurance claims to ensure your rights are protected and the process is handled correctly. Stay informed about the progress and advocate for a fair settlement to expedite the claims process effectively.

Conclusion

In conclusion, choosing the right insurance company for roof repairs in Texas is crucial to avoid financial strains, stress, and property value decline. Identifying red flags early on can prevent long-term consequences. Take immediate action after storm damage by documenting thoroughly and seeking professional assessments. Navigating the claims process step by step is essential for a successful outcome. Stay informed and aware to protect your rights and property investments. Make informed decisions to safeguard your home and peace of mind.

Frequently Asked Questions

What Are the Most Common Reasons for Insurance Claim Denials in Texas?

Insurance claim denials in Texas often stem from inadequate documentation, policy exclusions ignorance, and delayed filings. Understanding your policy, promptly reporting claims, and providing thorough documentation can help prevent claim denials.

How Can I Ensure My Roof Repair Claim is Accepted?

To ensure your roof repair claim is accepted, document the damage thoroughly, hire a reputable contractor, follow insurance guidelines precisely, and avoid delays in filing. Communicate clearly with your insurer and seek professional advice if needed.

What Should I Do If My Insurance Company Denies My Roof Repair Claim?

Contact a public adjuster to review your claim, challenge the denial, and negotiate on your behalf. Consider legal counsel if needed. Document all interactions with the insurance company. Review your policy for appeal procedures. Seek expert opinions to support your claim.