Roofing Company Fort Worth: Essential for Hail Damage Claims

Discover if you need a roofing company fort worth for your hail damage claim in Fort Worth Texas. Learn more on our blog!

What is a Public Adjuster and do I need one for my hail damage claim in Fort Worth Texas?

Key Highlights

- A public adjuster is a professional who can assist you with your hail damage claim in Fort Worth, Texas.

- They understand the insurance process and can help navigate the complexities of filing a claim.

- Public adjusters have experience in roof inspection, negotiation, and providing excellent customer service.

- Hiring a public adjuster is recommended for complex storm damage claims and when dealing with roofing contractors.

- Public adjusters can enhance the documentation and evidence for your claim, negotiate with insurance companies, and potentially improve the outcome of your claim.

Introduction

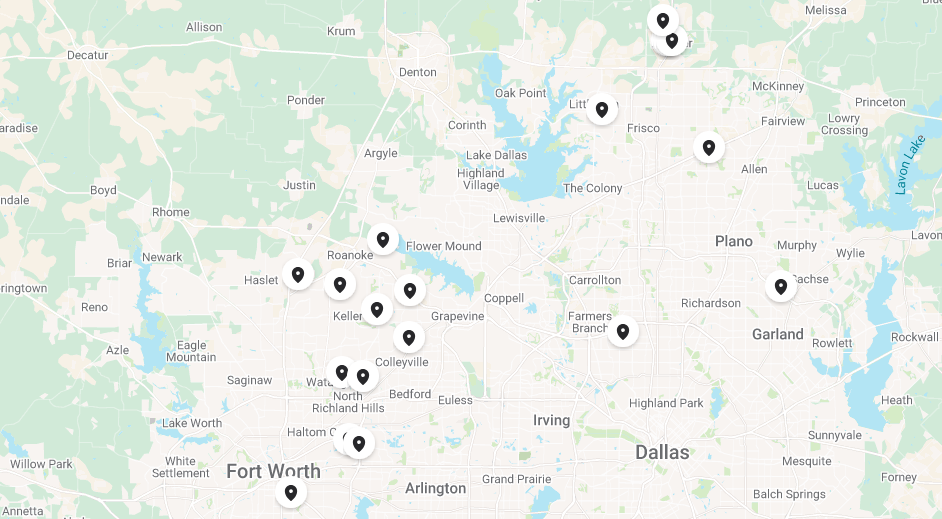

If you've experienced hail damage to your property in Fort Worth, Texas, you may be wondering what steps to take to file an insurance claim. Dealing with insurance claims can be a complex process, especially when it comes to assessing and repairing roof damage caused by hail storms. In such situations, hiring a reputable Fort Worth roofing company, like Lon Smith Roofing, rather than storm chasers, can be beneficial in navigating the process of roofing repairs and restoration, including commercial roofing services and roof repair. With 2,460 roofing companies servicing the area, according to Census Bureau data, it's important to do your research and find the best roofing contractors in North Richland Hills, Texas for your specific needs, including commercial roofing services and high-quality materials like GAF. As a Fort Worth roofing company that specializes in both residential and commercial roofing, we have the expertise and experience to handle any type of roofing project, including storm damage restoration and roof repair. Our team at Fort Worth Roofing Company is committed to excellence in every aspect of our business, providing exceptional customer care and earning prestigious accolades such as being a top-rated HomeAdvisor company and an Owens Corning Platinum Preferred Contractor. Trust us for all your roofing needs in Dallas, including commercial roofing services, roof repair, and quality of work.

A public adjuster is a licensed professional who works on behalf of policyholders to help them navigate the insurance process and maximize their claim settlement. They have in-depth knowledge of insurance policies, claim procedures, and the intricacies of hail damage. By hiring a public adjuster, you can ensure a smoother and more efficient claims process, as well as potentially increase your chances of receiving a fair and adequate settlement for your hail damage claim.

In this blog, we will explore the role of public adjusters in hail damage claims in Fort Worth, Texas. We will discuss what a public adjuster is, their responsibilities, and when it is advisable to consider hiring one for your claim. Additionally, we will provide information on the cost of hiring a public adjuster and highlight some prominent public adjuster firms in the Fort Worth area. By the end of this blog, you will have a better understanding of public adjusters and be able to make an informed decision regarding your hail damage claim.

Understanding Public Adjusters and Their Role in Hail Damage Claims in Fort Worth, Texas

Understanding the role of public adjusters in hail damage claims in Fort Worth, Texas is crucial when it comes to maximizing your insurance claim settlement. Public adjusters are professionals who specialize in assisting policyholders with the insurance claims process. They have extensive knowledge and experience in dealing with hail damage claims and can provide valuable expertise and guidance throughout the entire process. Whether it's assessing the severity of your hail damage, negotiating with insurance companies, or enhancing claim documentation, a public adjuster can play a vital role in ensuring a successful outcome for your claim.

Defining What a Public Adjuster Is

A public adjuster is an independent insurance professional who represents policyholders in the insurance claims process. Unlike insurance company adjusters who work for the insurance company, public adjusters work solely on behalf of the policyholder. Their primary role is to advocate for the policyholder and ensure they receive a fair and equitable settlement for their claim.

Public adjusters have a deep understanding of the insurance process and can assist with all aspects of a claim, from initial documentation to final settlement. They are trained to assess and document property damage, negotiate with insurance companies, and provide expert advice and guidance throughout the claims process. By hiring a public adjuster, policyholders can level the playing field and have someone with their best interests in mind working on their behalf to maximize their claim settlement.

The Primary Responsibilities of a Public Adjuster

Public adjusters have several primary responsibilities when it comes to hail damage claims. Firstly, they will conduct a thorough roof inspection to assess the extent of the damage caused by the hailstorm. This inspection is crucial in documenting the damage and providing evidence to support the claim.

Once the damage has been assessed, the public adjuster will assist in preparing and filing the insurance claim. This involves gathering all necessary documentation, including photos, estimates, and any other relevant evidence. They will also handle all communication and negotiation with the insurance company on behalf of the policyholder.

Furthermore, public adjusters provide exceptional customer service throughout the claims process. They act as a point of contact for the policyholder, addressing any questions or concerns they may have. Public adjusters are dedicated to ensuring a smooth and efficient claims experience for their clients, providing peace of mind during a stressful time.

When to Consider Hiring a Public Adjuster for Your Claim

Knowing when to consider hiring a public adjuster for your hail damage claim is essential. While it may not be necessary for every claim, there are certain situations where the expertise of a public adjuster can be invaluable.

Firstly, if you have experienced significant storm damage, such as extensive roof damage, it is advisable to consult a public adjuster. They can assess the severity of the damage and ensure that all necessary repairs are included in your claim.

Additionally, if your claim is complex, involving multiple parties or insurance coverages, a public adjuster can help navigate the complexities of the process. They have the expertise to handle complex claims and can provide guidance on the best course of action.

Furthermore, hiring a public adjuster can be beneficial when dealing with roofing contractors. Public adjusters have experience working with contractors and can ensure that the necessary repairs are completed to a high standard. They can also help negotiate fair pricing and ensure that the insurance company covers the cost of the repairs, with extended warranties available for even longer-lasting peace of mind.

Identifying the Severity of Your Hail Damage

Identifying the severity of your hail damage is crucial in understanding the extent of the repairs needed and the potential costs involved. A professional roof inspection, such as our Free Inspection and Roof Replacement Estimate, conducted by a public adjuster can help assess the severity of the damage and ensure that all necessary repairs, including a new roof, are included in your claim. Here are some key points to consider when identifying the severity of your hail damage, including the exterior of your home:

- Conduct a professional roof inspection: A public adjuster can assess the roof for any signs of damage, such as cracked or missing shingles, dents, or punctures.

- Document the damage: Take detailed photographs of the damage to provide evidence for your claim.

- Check for leaks: Look for any signs of leaks or water damage inside your home, as these could indicate roof damage.

- Assess the age and condition of your roof: Older roofs or roofs in poor condition may be more susceptible to hail damage.

- Consider the size of the hailstones: Larger hailstones are more likely to cause significant damage to your roof.

By accurately identifying the severity of your hail damage, you can ensure that your claim covers all necessary repairs and that you receive a fair settlement from your insurance company.

Evaluating the Complexity of Your Insurance Claim

Evaluating the complexity of your insurance claim is crucial in determining whether hiring a public adjuster is necessary. Some claims may be straightforward and can be handled directly with the insurance company. However, certain situations may require the expertise of a public adjuster to navigate the complexities of the claims process.

Complex claims may involve multiple parties, such as subcontractors or other insurance coverages. They may also require extensive documentation and negotiation with the insurance company. Public adjusters have the knowledge and experience to handle complex claims and can provide project management expertise to ensure a successful outcome.

Additionally, the complexity of your insurance policy may also impact the need for a public adjuster. Policies with intricate coverage provisions or exclusions may require the assistance of a public adjuster to interpret and navigate the terms effectively.

By evaluating the complexity of your insurance claim, you can determine whether the expertise of a public adjuster is necessary to ensure a fair and satisfactory settlement.

How Public Adjusters Can Influence Your Insurance Claim Outcome

Public adjusters can have a significant influence on the outcome of your insurance claim. Their expertise in negotiating with insurance companies and advocating for policyholders can help ensure a fair and adequate settlement.

One way public adjusters influence the claim outcome is through their expert negotiation skills. They have in-depth knowledge of insurance policies and the claims process, allowing them to effectively communicate and negotiate with insurance company adjusters.

Additionally, public adjusters can enhance the documentation and evidence for your claim. By thoroughly documenting the damage and providing detailed estimates and photos, they can present a strong case to the insurance company, increasing the likelihood of a favorable outcome.

Overall, public adjusters play a vital role in maximizing your claim settlement by effectively negotiating with insurance companies and ensuring that all necessary repairs and damages are covered.

Enhancing Claim Documentation and Evidence

Public adjusters excel in enhancing claim documentation and gathering the necessary evidence to support your hail damage claim. Documentation and evidence are critical in proving the extent of the damage and justifying the costs of repairs to the insurance company. Here's how public adjusters can enhance claim documentation and evidence:

- Thoroughly document the damage: Public adjusters will conduct a detailed inspection of your property, documenting all visible damage caused by the hailstorm.

- Take photographs: Public adjusters will take high-quality photographs of the damage, capturing all angles and areas affected.

- Obtain estimates: Public adjusters will gather multiple estimates from reputable contractors to provide accurate cost assessments for the repairs.

- Keep detailed records: Public adjusters maintain meticulous records of all documentation, ensuring nothing is overlooked during the claims process.

By enhancing claim documentation and evidence, public adjusters strengthen your case and improve the likelihood of a successful claim settlement. They ensure that all necessary repairs and damages are accounted for, ensuring a fair and equitable settlement from your insurance company.

Negotiating with Insurance Companies on Your Behalf

One of the primary responsibilities of a public adjuster is negotiating with insurance companies on behalf of policyholders. Public adjusters have extensive experience in handling insurance claims and are skilled negotiators. Here's how they negotiate with insurance companies:

- Thoroughly review the insurance policy: Public adjusters carefully analyze the policy to determine what is covered and negotiate for the maximum benefit.

- Present a strong case: Public adjusters gather all necessary documentation, evidence, and estimates to support your claim and negotiate for a fair settlement.

- Handle all communication: Public adjusters manage all correspondence with the insurance company, ensuring clear and effective communication throughout the process.

- Advocate for your rights: Public adjusters act as your advocate, fighting for your best interests and ensuring that you receive the compensation you deserve.

By negotiating with insurance companies on your behalf, public adjusters level the playing field and ensure that you are treated fairly throughout the claims process. They have the skills and knowledge to navigate the complexities of insurance claims, increasing the likelihood of a successful outcome.

The Cost of Hiring a Public Adjuster in Fort Worth, Texas

Understanding the cost of hiring a public adjuster in Fort Worth, Texas is an important consideration when deciding whether to hire one for your hail damage claim. Public adjusters typically charge fees based on the settlement amount of your claim. The most common fee structure for public adjusters is a contingency fee, which means their fees are a percentage of the final settlement. The specific percentage can vary but typically ranges from 5% to 20%. It's important to discuss the fee structure and any additional charges with the public adjuster before hiring them to ensure transparency and avoid any unexpected expenses.

Typical Fee Structures for Public Adjusters

Public adjusters typically charge fees based on the settlement amount of your claim. The most common fee structure is a contingency fee, which means their fees are a percentage of the final settlement. The specific percentage can vary depending on the complexity of the claim and the services provided by the public adjuster. Here are some typical fee structures for public adjusters:

- Percentage-based fees: Public adjusters may charge a percentage of the final settlement, typically ranging from 5% to 20%.

- Flat fees: In some cases, public adjusters may charge a flat fee for their services, regardless of the settlement amount.

- Additional charges: Public adjusters may also charge additional fees for specific services, such as filing paperwork or conducting additional inspections.

It's important to discuss the fee structure and any additional charges with the public adjuster before hiring them to ensure transparency and avoid any surprises.

Understanding Contingency Fees and Other Charges

Contingency fees are the most common fee structure used by public adjusters. These fees are based on a percentage of the final settlement amount and are only payable if the claim is successful. Here's what you need to know about contingency fees and other charges:

- Contingency fees: Public adjusters typically charge a percentage of the final settlement as their fee. The specific percentage can vary depending on the complexity of the claim and the services provided.

- Additional charges: In addition to contingency fees, public adjusters may charge additional fees for specific services, such as filing paperwork or conducting additional inspections. It's important to clarify these charges upfront with the public adjuster.

When hiring a public adjuster, it's essential to understand the fee structure and any additional charges to ensure transparency and avoid any surprises. Discussing fees and charges with the public adjuster before hiring them will help you make an informed decision.

Prominent Public Adjuster Firms in Fort Worth, Texas

If you're considering hiring a public adjuster for your hail damage claim in Fort Worth, Texas, it's important to choose a reputable and experienced firm. Here are some prominent public adjuster firms in Fort Worth:

- Abba Claims Consultants LLC: Known for their exceptional customer service and professionalism, Abba Claims Consultants LLC has a proven track record of successfully handling hail damage claims in Fort Worth.

- C3 Adjusters: C3 Adjusters is a trusted public adjuster firm that specializes in providing claim assistance and expertise to policyholders in Fort Worth. Their team of experienced adjusters ensures that clients receive the maximum settlement for their claims.

- National Claims Negotiators: With years of experience in negotiating claims, National Claims Negotiators has established a reputation for their expertise in handling hail damage claims in Fort Worth. Their team of skilled negotiators works diligently to secure favorable outcomes for their clients.

When choosing a public adjuster firm, it's important to consider customer reviews, expertise, and professionalism to ensure you receive the best possible representation for your hail damage claim.

Abba Claims Consultants LLC

Abba Claims Consultants LLC is a reputable public adjuster firm known for their exceptional customer service and professionalism. With a team of experienced adjusters, they specialize in handling hail damage claims in Fort Worth, Texas. Here's what sets Abba Claims Consultants LLC apart:

- Excellent customer service: Abba Claims Consultants LLC is committed to providing their clients with exceptional customer service throughout the claims process. They prioritize communication and ensure that clients are well-informed and supported every step of the way.

- Professionalism: Their team of adjusters exhibits the highest level of professionalism in dealing with insurance companies and advocating for their clients. They have the expertise and knowledge to navigate the complexities of hail damage claims and negotiate for fair settlements.

If you're looking for a public adjuster firm in Fort Worth, Texas, Abba Claims Consultants LLC is known for their dedication to customer service and professionalism.

C3 Adjusters

C3 Adjusters is a trusted public adjuster firm that specializes in providing claim assistance and expertise to policyholders in Fort Worth, Texas. With their team of experienced adjusters, they have established a reputation for excellence in handling hail damage claims. Here's what sets C3 Adjusters apart:

- Claim assistance: C3 Adjusters understands the complexities of the claims process and provides tailored assistance to their clients. They guide policyholders through the entire process, ensuring they receive the maximum settlement for their claims.

- Expertise: Their team of adjusters has extensive knowledge and experience in handling hail damage claims. They stay up-to-date with the latest industry trends and regulations to provide the best possible representation for their clients.

If you're in need of a public adjuster firm in Fort Worth, Texas, C3 Adjusters can provide expert claim assistance and ensure that you receive a fair settlement for your hail damage claim.

National Claims Negotiators

National Claims Negotiators is a public adjuster firm with years of experience in negotiating claims in Fort Worth, Texas. Their team of skilled negotiators specializes in handling hail damage claims and ensuring that policyholders receive fair and equitable settlements. Here's what makes National Claims Negotiators stand out:

- Negotiation expertise: Their team of adjusters has extensive experience in negotiating with insurance companies. They understand the tactics used by insurance companies and can effectively advocate for their clients to secure the best possible outcome.

- Years of experience: With years of experience in the industry, National Claims Negotiators has established a reputation for their expertise in handling hail damage claims. They have a deep understanding of the claims process and can guide policyholders through every step.

When it comes to hail damage claims in Fort Worth, Texas, National Claims Negotiators offers the expertise and negotiation skills needed to secure a fair settlement.

Evaluating the Need for a Public Adjuster

Evaluating the need for a public adjuster is an important step when dealing with hail damage claims. While not every claim may require the services of a public adjuster, there are certain factors to consider when assessing the need for their expertise. These factors include the severity of the hail damage, the complexity of the insurance claim, and the involvement of roofing contractors. By evaluating these factors, you can make an informed decision about whether hiring a public adjuster is necessary for your hail damage claim in Fort Worth, Texas.

Assessing the Benefits vs. Costs

When considering whether to hire a public adjuster for your hail damage claim, it's crucial to assess the benefits versus the costs. While hiring a public adjuster can increase the likelihood of a successful claim and maximize your settlement, there are associated fees to consider. Here are some benefits and costs to consider:

Benefits:

- Expertise: Public adjusters have extensive knowledge of the insurance claims process and can navigate its complexities on your behalf.

- Higher settlement: Public adjusters have the negotiation skills to advocate for a fair and equitable settlement.

- Peace of mind: With a public adjuster handling your claim, you can focus on other aspects of recovery while knowing that your claim is in capable hands.

Costs:

- Contingency fees: Public adjusters typically charge a percentage of the final settlement as their fee.

- Additional charges: Public adjusters may charge additional fees for specific services.

By weighing the benefits against the costs, you can make an informed decision about whether hiring a public adjuster is the right choice for your hail damage claim.

Making an Informed Decision for Your Hail Damage Claim

When it comes to your hail damage claim, making an informed decision about whether to hire a public adjuster is crucial. Consider the severity of the damage, the complexity of the claim, and your comfort level with navigating the insurance process. If the damage is extensive, the claim is complex, or you simply prefer to have an expert handling your claim, hiring a public adjuster may be the right choice for you. By weighing the benefits and costs, you can make an informed decision that will maximize your claim settlement and provide peace of mind throughout the claims process.

Conclusion

In conclusion, the decision to hire a public adjuster for your hail damage claim in Fort Worth, Texas depends on various factors such as the extent of damage and complexity of the insurance claim. Public adjusters can significantly influence the outcome of your claim by providing expertise in documentation, negotiation with insurance companies, and potentially maximizing your payout. Consider evaluating the benefits versus the costs involved in hiring a public adjuster to make an informed decision that aligns with your specific situation. Conduct thorough research on reputable public adjuster firms in Fort Worth, Texas and verify their credentials before making a final choice to ensure a smooth and efficient claims process.

Frequently Asked Questions

When should I first contact a public adjuster after hail damage?

It is advisable to contact a public adjuster as soon as possible after hail damage occurs. The earlier you involve a public adjuster, the better they can assess the damage, document it, and assist you throughout the claims process. Timing is crucial in ensuring a smooth and successful claims experience.

Will hiring a public adjuster speed up my claim process?

Yes, hiring a public adjuster can potentially speed up your claim process. Public adjusters have the expertise and knowledge to navigate the complexities of the claims process efficiently. They can handle all documentation, communication, and negotiation on your behalf, reducing delays and ensuring a more streamlined claims experience.

How do public adjusters differ from insurance company adjusters?

Public adjusters differ from insurance company adjusters in that they work on behalf of the policyholder, while insurance company adjusters work for the insurance company. Public adjusters advocate for the policyholder and ensure they receive a fair settlement, while insurance company adjusters represent the interests of the insurance company.

Can a public adjuster guarantee a higher payout for my claim?

While public adjusters cannot guarantee a higher payout for your claim, their expertise in negotiating with insurance companies can increase the likelihood of a fair and equitable settlement. They can advocate for your best interests and present a strong case to maximize your claim settlement.

What should I look for when choosing a public adjuster in Fort Worth, Texas?

When choosing a public adjuster in Fort Worth, Texas, it's important to consider their experience, reputation, and customer reviews. Look for a public adjuster who specializes in hail damage claims, has a proven track record, and demonstrates professionalism and excellent customer service.

Are there any risks involved in hiring a public adjuster?

While hiring a public adjuster can be beneficial, there are some considerations and potential risks to be aware of. These include the cost of their services, the possibility of delays if they are handling multiple claims, and the need to carefully review their contract and fee structure before signing.

How can I verify the credentials of a public adjuster?

To verify the credentials of a public adjuster, you can check their licensing and certifications. Public adjusters must be licensed in the state where they practice, and they may also hold certifications from professional organizations. You can contact your state's insurance department or search online directories to verify their credentials.

Our Location

Hours

Hours

Contact Us

License # 03-0235