Guide To Find the Best Homeowners Insurance Policy for Fort Worth 2024: from a Seasoned Roofing Expert

This is a subtitle for your new post

Guide To Find the Best Homeowners Insurance Policy for Fort Worth 2024: from a Seasoned Roofing Expert

With Fort Worth’s unpredictable weather, securing the best homeowners insurance policy for Fort Worth 2024 regarding roofing claims is crucial. Don’t get caught off-guard by costly damages. Our concise guide zeroes in on the best homeowners insurance policy options that deliver when you file a roofing claim in Fort Worth. We’ll highlight the insurers known for easy claims processing and robust coverage—valuable insights await for safeguarding your home.

Key Takeaways

- Homeowners in Fort Worth should prioritize robust insurance policies covering hail and windstorm damage due to the prevalence of extreme weather events, with the average annual wind and hail claim reaching around $12,000.

- Homeowners need to be aware of key coverage features, including the choice between replacement cost coverage and actual cash value, and consider supplemental policies such as those offered by the Texas Windstorm Insurance Association for comprehensive protection.

- When selecting a homeowners insurance policy, Fort Worth residents should consider factors like the insurer’s customer service reputation, claim resolution fairness, and customization options that fit unique needs, while also actively seeking out discounts to minimize premiums.

Fort Worth Roofing Claims: Homeowners Insurance Overview

If you’re planting your roots in Fort Worth, homeowners insurance is as essential as a sturdy pair of boots. The city’s penchant for extreme weather events, from hailstorms to tornadoes, leaves homeowners particularly vulnerable to high repair costs. It’s not just about having a policy; it’s about having the right coverage to ensure the homestead stands strong after a storm.

For Texas homeowners, the stakes are as high as the state’s famed sky. The average annual wind and hail claim can skyrocket to a staggering $12,000, a sum that can rattle any family’s financial foundation. Such figures underscore the importance of a robust insurance policy, safeguarding your investment from the unpredictable fury of Lone Star weather.

Many homeowners are bound by the requirements of mortgage lenders to maintain insurance, but even for those who own their homes outright, forgoing coverage is akin to playing roulette with your roof. In Fort Worth, insurance isn’t just a safety net; it’s a cornerstone of responsible home ownership.

Identifying Top Homeowners Insurance Companies in Texas

Navigating the sea of Texas homeowners insurance companies can be as challenging as corralling a herd of cattle. Yet, some insurers stand tall like beacons in the night, guiding homeowners to safe harbor. Among them, the top Texas homeowners insurance companies are:

- Chubb

- Lemonade

- Amica

- Texas Farm Bureau

These companies shine, thanks to their fair claims resolution and sterling communication.

These companies not only offer a variety of coverage options but also have a reputation for reliability, making them some of the best home insurance companies. In fact, one could argue that they are among the best homeowners insurance company options available. Some of the top home insurance companies for homeowners are:

- USAA: Offers replacement cost for personal belongings in its standard homeowners insurance policy and is a haven for veterans and service members.

- Nationwide: Known for additional coverages like water backup and identity theft at an extra cost.

- Farmers: Offers tiered plans to cater to homeowners at every level, ensuring there’s a policy to fit every homeowner’s unique needs.

When it comes to roofing claims, Amica and Texas Farm Bureau don’t just talk the talk; they walk the walk with excellent customer service and multiple policy discounts. And let’s not forget the value of a good ranking system, as devised by a local roofing expert, placing Chubb and Pure at the pinnacle for their supreme coverage limits and communication prowess. Below is how local roofing expert Sean Becker and his team ranked insurance carriers for 2024.

Pure: 9.9 in claims resolution

Chubb: 9.9 Super easy to work with and overly fair to customers

Amica: 9.9 is right up there with Pure and Chubb in fairness and speed to resolve claims. They are hands down the easiest to deal with and quickest to resolve claims, and not have the homeowner submit a million requests.

USAA: 9.5 has a long standing reputation of being fair and on the homeowners side

Texas Farm Bureau: 9.4 one of the biggest insurers of ranch properties. They take care of their customers!

Farmers: 9.3 During covid they allowed homeowner’s contractors to submit claim photos for almost instant claim payouts. We saw claims paid and an initial payment to the customer sometimes within 24 hrs from filing!

Nationwide: 9.3 They have awesome policies allowing customers to upgrade the roof, on each roof replacement claim. This makes the roof stronger and much less of a risk for the next storms!

Lemonade: 9.3 Easy to work with. Fast on the claims

Liberty Mutual: 9.0 Fast to cover damaged losses. They do not miss damage like the other big insurance carriers.

Safeco: 9.0 operates similarly to Liberty Mutual.

Are some of our favorite runner ups to the top three. These companies have been very stand up in the inspection side of claims. Calling damage, damage!

Essential Coverage Features for Fort Worth Residents

As Fort Worth residents well know, the right homeowners insurance policy must be as resilient as the city’s spirit. Key coverage features to look for include protection against hail and windstorm damage, the option for replacement cost coverage, and enhanced roofing materials coverage. Each component acts as another layer of protection against the financial impact of the city’s fierce weather, ensuring your home remains your stronghold.

Windstorm Insurance and Hail Protection

When the winds howl and hail pelts down like a scene from an old Western, standard homeowners insurance policies in Fort Worth typically offer sanctuary with coverage for wind and hail damage. Yet, there are times when the standard just won’t do, and a separate windstorm insurance policy becomes as necessary as a lasso for a cowboy. Such is the case when private insurers decline coverage, leaving homeowners to seek refuge with the Texas Windstorm Insurance Association (TWIA).

Financial protection against these calamities is not to be taken lightly. Consider TGS Insurance Agency’s approach, which includes a 2% hail/wind deductible in every policy, translating to a $5,000 responsibility for homeowners on a $250,000 dwelling coverage in the event of a claim. This makes the right insurance coverage not just a choice, but a financial imperative for Fort Worth residents.

USAA stands as a beacon for those in the path of windstorms and hurricanes, offering specialized insurance in its standard policies, ideal for those who may face the wrath of such weather events. It’s a testament to the value of choosing a homeowners insurance company that understands the unique challenges posed by the Texas climate.

Replacement Cost vs. Actual Cash Value

When misfortune strikes and damages your homestead, the method of compensation can make all the difference. Replacement cost coverage is the ultimate defender, offering to rebuild your home with like kind and quality materials without factoring in depreciation. Actual cash value, on the other hand, is the shrewd accountant, paying out the market value of your property at the time of damage, minus depreciation.

The choice between these two is not just about coverage—it’s about peace of mind. Replacement cost coverage might carry higher premiums, but it ensures that the heart of your home—its roof—can be restored to its former glory without the worry of depreciation. It’s a premium worth paying for those who wish to stand firm against the tests of time and nature.

Fort Worth homeowners must carefully consider their financial situation when choosing between these two options. Insurance companies have a duty to make clear how depreciation will affect claim payouts, whether the policy offers recoverable or non-recoverable depreciation, and how this will influence the outcome of roofing claims. For full recovery of depreciation, repairs must be completed within specified timeframes, making the decision all the more critical.

Enhanced Roofing Materials Coverage

In the quest for the ultimate roof over one’s head, enhanced roofing materials coverage emerges as a lighthouse guiding ships through a storm. Nationwide’s Better Roof Replacement allows homeowners to upgrade to stronger materials, fortifying their homes against future onslaughts. Similarly, Liberty Mutual rewards those who choose impact-resistant materials with discounts, paving the way for long-term savings and improved protection.

Having a roof that can stand up to Fort Worth’s punishing weather not only provides peace of mind but also financial perks. Upgrading to impact-resistant or noncombustible materials can lead to insurance discounts, underscoring the tangible benefits of investing in your home’s first line of defense. Moreover, warranties like the GAF Golden Pledge provide an ironclad promise of quality, covering manufacturing defects for up to 50 years and installation errors for up to 30 years.

The role of a reputable roofing contractor includes:

- Bringing expertise in selecting the right shingle brands and recommending the best materials

- Enhancing your roof and bolstering your position when dealing with insurance claims

- Ensuring that the warranties provided, which typically cover tear-off and disposal costs, add an extra layer of protection for homeowners, even if the original contractor is no longer in business.

How to Find the Best Insurance Company for Your Needs

The journey to find the best home insurance company in Fort Worth is not unlike navigating the Trinity River—twists and turns abound, but the right guide can lead you to calm waters. The beacon of excellent customer service should always guide your way, coupled with adherence to Texas Department of Insurance guidelines to ensure fair treatment during claims assessments and payments.

Customization in your policy is akin to tailoring a fine suit—it must fit your unique needs perfectly. Seek out insurers that offer flexibility and coverage options that can be tailored to your specific situation, such as identity theft protection or varying levels of depreciation. And remember, comparing multiple insurance options is as essential as a cowboy’s comparison of boots before a purchase. Shop around, get quotes, and understand the optional coverages and discounts offered by different insurers in the Lone Star State. You may need to invest some time in this process, but it will be worth it in the end.

Additional features such as clear guidelines on ALE and a fair appraisal process sweeten the deal. Personalized assistance from independent agents or expert advice can help you navigate the complexities of insurance, ensuring you’re as well-equipped as a Fort Worth cowboy at the rodeo.

Understanding Homeowners Insurance Costs in Fort Worth

The cost of homeowners insurance in Fort Worth is as varied as the Texas landscape. On average, Texas homeowners insurance rates can be around $2,090 per year for $250,000 of dwelling coverage, with some companies like Farmers offering more wallet-friendly premiums. Yet, it’s the confluence of factors like the high cost of roof replacements and the frequency of hail storms that dictate the premiums more than anything else.

Fort Worth residents renewing their policies in 2024 will feel the pinch of rate increases, reflecting the broader impact of higher replacement costs, inflation, and a state-wide premium hike due to weather-related damages. Insurers, wary of the increasing frequency and severity of events like the Texas heat wave, are tightening their belts, leading to stricter coverage rules and steeper premiums.

Understanding these costs is vital for homeowners, as it equips them with the knowledge to make informed decisions about their coverage. It ensures that when the skies darken and the winds pick up, the financial foundation of their homes remains as unshakeable as the resolve of the Texan spirit.

Maximizing Discounts and Savings on Homeowners Insurance

In the grand state of Texas, savvy homeowners know the value of a dollar and the importance of stretching it as far as possible, especially when it comes to insurance. Here are some tips to help you save money on your home insurance:

- Install safety features like smoke detectors or a security system to qualify for discounts.

- Regularly maintain your property to demonstrate its value and reduce the risk of damage.

- Personalize your belongings with identifying marks to deter theft and potentially lower your premiums.

By following these tips, you can make your home safer and your wallet heavier.

Some ways to save on insurance premiums include:

- Bundling policies, such as home and auto

- Choosing payment options like automatic payments or prepaying premiums

- Upgrading to impact-resistant roofing materials

- Being a seasoned resident or claim-free homeowner, which may make you eligible for premium discounts

These strategies can help you save money in the long run and protect your home against the elements.

Navigating Roofing Claims with Your Insurer

When the storm clouds gather and the rain starts to pound, knowing how to navigate roofing claims with your insurer can mean the difference between a seamless repair process and a financial headache. The path involves:

- Verifying coverage

- Involving a licensed roofing contractor

- Obtaining multiple estimates

- Working with insurance adjusters

- Providing thorough documentation

Each step is crucial in ensuring that when hailstones leave their mark, the claims process is as smooth as the calm after the storm.

Documentation and Evidence Collection

The aftermath of a storm in Fort Worth is not the time for tall tales; it’s a time for facts, supported by detailed documentation. After the winds die down, it is crucial to collect evidence of roof damage immediately. Involving a roofing contractor early to inspect and document the damage is like calling in the cavalry—it ensures that you have an expert’s eye on the situation.

The documentation must be as comprehensive as the Texas sky, with photographs and a detailed report that outlines the extent of the damage and the repairs needed. This not only aids in the accuracy of the roofing claim but also serves as undeniable proof to the insurance company, ensuring that your claim is taken as seriously as a Texas drought.

Working with Adjusters and Contractors

In the realm of roofing claims, adjusters and contractors play a crucial role, much like a rancher and his trusty foreman. After a major storm, construction costs can soar, which makes carrying enough insurance to cover these potential spikes as important as having a steady supply of water during a Texas heatwave. Homeowners should also be wary of contractors demanding payment upfront, as this can be a red flag for unreliable service.

Once a claim is in motion, an insurance adjuster rides in to independently assess the damage. It’s then that the adjuster should join forces with the homeowner’s chosen roofing contractor to ensure that repairs are properly facilitated and that the homestead is restored to its former glory. This collaboration is as essential as a well-oiled saddle, ensuring that both parties work together for the benefit of the home and its occupants.

Dispute Resolution and Advocacy

Navigating insurance claims can sometimes feel like trying to calm a wild bronco. It’s not uncommon for insurance companies to attribute roof damage to age rather than weather, but homeowners can challenge this by collecting robust evidence or getting an independent assessment. If the insurer remains as stubborn as a mule, legal aid in Fort Worth can step in, advocating for fair treatment and providing options like hiring independent adjusters or seeking legal assistance when necessary.

Should disputes arise, homeowners are not left out in the dust. They can take the following steps to address their concerns:

- File a formal written appeal with their insurer.

- Take their concerns to the Texas Department of Insurance if they suspect they’re getting the short end of the stick.

- Consider mediation as a peaceful path forward.

- If necessary, take legal action within two years from the date of the incident.

Supplemental Policies for Comprehensive Protection

The wide-open spaces of Texas are beautiful but can also be unforgiving, making supplemental policies a must for comprehensive protection. The Texas Windstorm Insurance Association (TWIA) steps in like a trusty sidekick when other insurers turn homeowners away, providing coverage for windstorm and hail damage. TWIA’s coverage is robust, but it requires compliance with building codes, and in some flood zones, proof of flood insurance—a smart move in a state where floods can arrive as swiftly as a summer storm.

Flood insurance is essential for Fort Worth’s residents, as standard home insurance policies typically don’t cover flood damage. Homeowners must look to the National Flood Insurance Program or private insurers like Chubb for separate policies to stay afloat financially if floodwaters rise. Chubb goes above and beyond, offering coverage for hurricanes and windstorms, and even a Property Manager service for seasonal homes—proving that sometimes, the extra mile is worth the journey for unparalleled peace of mind.

Another consideration for comprehensive coverage is sewer backup insurance. The damage caused by drain and sewer clogs can be as messy and costly as a mudslide after heavy rain, and standard home insurance policies usually don’t protect against this risk. Therefore, investing in supplemental sewer backup coverage can save homeowners from a potential financial quagmire.

Local Agent or Digital Insurance: Which Suits You Best?

In today’s digital age, Fort Worth homeowners face a modern-day crossroads: choosing between the traditional touch of a local agent or the sleek convenience of digital insurance. Digital insurance platforms are the new frontier, allowing policy management and claim filing anytime, anywhere, much like the 24/7 hustle of a cattle market. With the integration of AI, IoT, and Blockchain, these platforms provide real-time access to policy information, optimizing the insurance experience and allowing for a level of customer empowerment previously unseen.

The virtual world also tends to reduce overhead costs, leading to potential savings on premiums for policyholders—an attractive prospect as appealing as a sunset over the prairie. Artificial intelligence and predictive analytics enhance the capacity of digital insurance platforms to detect fraud, a modern-day equivalent of a sharp-eyed sheriff keeping the peace. The use of low-code platforms in digital insurance means capabilities can be quickly adapted or created, streamlining operations and ensuring the insurance process runs as smoothly as a well-tuned fiddle.

Yet, for some, the personal touch of a local agent is irreplaceable. These knowledgeable guides offer personalized advice and can help navigate the complexities of insurance coverage with the familiarity and comfort of a neighborly handshake. They can advocate for homeowners in ways that a digital platform may not, providing a sense of security as warm as a Texas welcome.

Ultimately, the choice between a local agent and digital insurance depends on individual preferences for convenience, cost, and personal service.

Fort Worth Specifics: Home Insurance Tailored to Texan Weather

Fort Worth’s vibrant character is matched only by the volatility of its weather, making tailored home insurance as essential as a good pair of cowboy boots. The city’s hot climate ushers in a variety of severe weather conditions, from hailstorms, aptly earning it the nickname ‘Hail Alley’, to the occasional tornado that can sweep through with little warning. Homeowners insurance policies in Fort Worth must be robust enough to cover the frequent hail and windstorms, ensuring effective management of roofing claims and peace of mind when the skies turn gray.

In addition to the hail and wind, Texans must also prepare for hurricanes and wildfires, both of which are prevalent causes of home insurance claims in the state. It’s not just about having insurance; it’s about having the right home insurance in Texas, tailored to the unique climate of Fort Worth and the greater Texas region. Homeowners need insurers that understand these local risks and provide comprehensive coverage that stands as strong as the Alamo against the elements.

Securing the right insurance in Fort Worth means being prepared for everything the Texas weather has to offer. It’s about ensuring that when the wind picks up and the hail starts to fall, your home remains a sanctuary, unscathed by the tempest outside.

Summary

Through the vast and varied landscape of Fort Worth’s homeowners insurance market, the journey can be daunting, but armed with the right information, it can also be rewarding. From identifying the best insurance companies to understanding the coverage you need, to navigating claims and seizing opportunities for savings, every step is part of the dance with the elements. Homeowners who are empowered with knowledge and the right coverage can rest easy, knowing their homestead is protected against whatever the Texas skies may bring. May your policy be as strong as your Texas pride, and may your home always be as welcoming as a Fort Worth sunset.

Frequently Asked Questions

What is the average homeowners insurance premium in Texas?

The average homeowners insurance premium in Texas is $2,959 per year, which is higher than the national average. It's crucial to find a policy that suits your specific needs and provides financial protection for your home and assets.

What is the most extensive home insurance policy?

The most extensive home insurance policy is an HO-5 policy, which provides comprehensive coverage for rebuilding your house and replacing personal belongings, excluding events like flood and earthquake damage.

Does the age of a roof affect homeowners insurance?

Yes, the age of your roof does affect your homeowners insurance. Insurance companies may not cover roofs older than 20 years and may require an inspection for older roofs before offering coverage.

What are key coverage features I should look for in a Fort Worth homeowners insurance policy?

When looking for a Fort Worth homeowners insurance policy, it's crucial to prioritize coverage for hail and windstorm damage, replacement cost coverage, and enhanced roofing materials coverage for comprehensive protection against local weather conditions.

Can I get discounts on my homeowners insurance in Fort Worth?

You can maximize discounts on your homeowners insurance in Fort Worth by installing safety features, performing regular property maintenance, and bundling policies. Being claim-free for several years or a senior citizen may also qualify you for additional discounts.

Guide To Find the Best Homeowners Insurance Policy for Fort Worth 2024: from a Seasoned Roofing Expert

With Fort Worth’s unpredictable weather, securing the best homeowners insurance policy for Fort Worth 2024 regarding roofing claims is crucial. Don’t get caught off-guard by costly damages. Our concise guide zeroes in on the best homeowners insurance policy options that deliver when you file a roofing claim in Fort Worth. We’ll highlight the insurers known for easy claims processing and robust coverage—valuable insights await for safeguarding your home.

Key Takeaways

- Homeowners in Fort Worth should prioritize robust insurance policies covering hail and windstorm damage due to the prevalence of extreme weather events, with the average annual wind and hail claim reaching around $12,000.

- Homeowners need to be aware of key coverage features, including the choice between replacement cost coverage and actual cash value, and consider supplemental policies such as those offered by the Texas Windstorm Insurance Association for comprehensive protection.

- When selecting a homeowners insurance policy, Fort Worth residents should consider factors like the insurer’s customer service reputation, claim resolution fairness, and customization options that fit unique needs, while also actively seeking out discounts to minimize premiums.

Fort Worth Roofing Claims: Homeowners Insurance Overview

If you’re planting your roots in Fort Worth, homeowners insurance is as essential as a sturdy pair of boots. The city’s penchant for extreme weather events, from hailstorms to tornadoes, leaves homeowners particularly vulnerable to high repair costs. It’s not just about having a policy; it’s about having the right coverage to ensure the homestead stands strong after a storm.

For Texas homeowners, the stakes are as high as the state’s famed sky. The average annual wind and hail claim can skyrocket to a staggering $12,000, a sum that can rattle any family’s financial foundation. Such figures underscore the importance of a robust insurance policy, safeguarding your investment from the unpredictable fury of Lone Star weather.

Many homeowners are bound by the requirements of mortgage lenders to maintain insurance, but even for those who own their homes outright, forgoing coverage is akin to playing roulette with your roof. In Fort Worth, insurance isn’t just a safety net; it’s a cornerstone of responsible home ownership.

Identifying Top Homeowners Insurance Companies in Texas

Navigating the sea of Texas homeowners insurance companies can be as challenging as corralling a herd of cattle. Yet, some insurers stand tall like beacons in the night, guiding homeowners to safe harbor. Among them, the top Texas homeowners insurance companies are:

- Chubb

- Lemonade

- Amica

- Texas Farm Bureau

These companies shine, thanks to their fair claims resolution and sterling communication.

These companies not only offer a variety of coverage options but also have a reputation for reliability, making them some of the best home insurance companies. In fact, one could argue that they are among the best homeowners insurance company options available. Some of the top home insurance companies for homeowners are:

- USAA: Offers replacement cost for personal belongings in its standard homeowners insurance policy and is a haven for veterans and service members.

- Nationwide: Known for additional coverages like water backup and identity theft at an extra cost.

- Farmers: Offers tiered plans to cater to homeowners at every level, ensuring there’s a policy to fit every homeowner’s unique needs.

When it comes to roofing claims, Amica and Texas Farm Bureau don’t just talk the talk; they walk the walk with excellent customer service and multiple policy discounts. And let’s not forget the value of a good ranking system, as devised by a local roofing expert, placing Chubb and Pure at the pinnacle for their supreme coverage limits and communication prowess. Below is how local roofing expert Sean Becker and his team ranked insurance carriers for 2024.

Pure: 9.9 in claims resolution

Chubb: 9.9 Super easy to work with and overly fair to customers

Amica: 9.9 is right up there with Pure and Chubb in fairness and speed to resolve claims. They are hands down the easiest to deal with and quickest to resolve claims, and not have the homeowner submit a million requests.

USAA: 9.5 has a long standing reputation of being fair and on the homeowners side

Texas Farm Bureau: 9.4 one of the biggest insurers of ranch properties. They take care of their customers!

Farmers: 9.3 During covid they allowed homeowner’s contractors to submit claim photos for almost instant claim payouts. We saw claims paid and an initial payment to the customer sometimes within 24 hrs from filing!

Nationwide: 9.3 They have awesome policies allowing customers to upgrade the roof, on each roof replacement claim. This makes the roof stronger and much less of a risk for the next storms!

Lemonade: 9.3 Easy to work with. Fast on the claims

Liberty Mutual: 9.0 Fast to cover damaged losses. They do not miss damage like the other big insurance carriers.

Safeco: 9.0 operates similarly to Liberty Mutual.

Are some of our favorite runner ups to the top three. These companies have been very stand up in the inspection side of claims. Calling damage, damage!

Essential Coverage Features for Fort Worth Residents

As Fort Worth residents well know, the right homeowners insurance policy must be as resilient as the city’s spirit. Key coverage features to look for include protection against hail and windstorm damage, the option for replacement cost coverage, and enhanced roofing materials coverage. Each component acts as another layer of protection against the financial impact of the city’s fierce weather, ensuring your home remains your stronghold.

Windstorm Insurance and Hail Protection

When the winds howl and hail pelts down like a scene from an old Western, standard homeowners insurance policies in Fort Worth typically offer sanctuary with coverage for wind and hail damage. Yet, there are times when the standard just won’t do, and a separate windstorm insurance policy becomes as necessary as a lasso for a cowboy. Such is the case when private insurers decline coverage, leaving homeowners to seek refuge with the Texas Windstorm Insurance Association (TWIA).

Financial protection against these calamities is not to be taken lightly. Consider TGS Insurance Agency’s approach, which includes a 2% hail/wind deductible in every policy, translating to a $5,000 responsibility for homeowners on a $250,000 dwelling coverage in the event of a claim. This makes the right insurance coverage not just a choice, but a financial imperative for Fort Worth residents.

USAA stands as a beacon for those in the path of windstorms and hurricanes, offering specialized insurance in its standard policies, ideal for those who may face the wrath of such weather events. It’s a testament to the value of choosing a homeowners insurance company that understands the unique challenges posed by the Texas climate.

Replacement Cost vs. Actual Cash Value

When misfortune strikes and damages your homestead, the method of compensation can make all the difference. Replacement cost coverage is the ultimate defender, offering to rebuild your home with like kind and quality materials without factoring in depreciation. Actual cash value, on the other hand, is the shrewd accountant, paying out the market value of your property at the time of damage, minus depreciation.

The choice between these two is not just about coverage—it’s about peace of mind. Replacement cost coverage might carry higher premiums, but it ensures that the heart of your home—its roof—can be restored to its former glory without the worry of depreciation. It’s a premium worth paying for those who wish to stand firm against the tests of time and nature.

Fort Worth homeowners must carefully consider their financial situation when choosing between these two options. Insurance companies have a duty to make clear how depreciation will affect claim payouts, whether the policy offers recoverable or non-recoverable depreciation, and how this will influence the outcome of roofing claims. For full recovery of depreciation, repairs must be completed within specified timeframes, making the decision all the more critical.

Enhanced Roofing Materials Coverage

In the quest for the ultimate roof over one’s head, enhanced roofing materials coverage emerges as a lighthouse guiding ships through a storm. Nationwide’s Better Roof Replacement allows homeowners to upgrade to stronger materials, fortifying their homes against future onslaughts. Similarly, Liberty Mutual rewards those who choose impact-resistant materials with discounts, paving the way for long-term savings and improved protection.

Having a roof that can stand up to Fort Worth’s punishing weather not only provides peace of mind but also financial perks. Upgrading to impact-resistant or noncombustible materials can lead to insurance discounts, underscoring the tangible benefits of investing in your home’s first line of defense. Moreover, warranties like the GAF Golden Pledge provide an ironclad promise of quality, covering manufacturing defects for up to 50 years and installation errors for up to 30 years.

The role of a reputable roofing contractor includes:

- Bringing expertise in selecting the right shingle brands and recommending the best materials

- Enhancing your roof and bolstering your position when dealing with insurance claims

- Ensuring that the warranties provided, which typically cover tear-off and disposal costs, add an extra layer of protection for homeowners, even if the original contractor is no longer in business.

How to Find the Best Insurance Company for Your Needs

The journey to find the best home insurance company in Fort Worth is not unlike navigating the Trinity River—twists and turns abound, but the right guide can lead you to calm waters. The beacon of excellent customer service should always guide your way, coupled with adherence to Texas Department of Insurance guidelines to ensure fair treatment during claims assessments and payments.

Customization in your policy is akin to tailoring a fine suit—it must fit your unique needs perfectly. Seek out insurers that offer flexibility and coverage options that can be tailored to your specific situation, such as identity theft protection or varying levels of depreciation. And remember, comparing multiple insurance options is as essential as a cowboy’s comparison of boots before a purchase. Shop around, get quotes, and understand the optional coverages and discounts offered by different insurers in the Lone Star State. You may need to invest some time in this process, but it will be worth it in the end.

Additional features such as clear guidelines on ALE and a fair appraisal process sweeten the deal. Personalized assistance from independent agents or expert advice can help you navigate the complexities of insurance, ensuring you’re as well-equipped as a Fort Worth cowboy at the rodeo.

Understanding Homeowners Insurance Costs in Fort Worth

The cost of homeowners insurance in Fort Worth is as varied as the Texas landscape. On average, Texas homeowners insurance rates can be around $2,090 per year for $250,000 of dwelling coverage, with some companies like Farmers offering more wallet-friendly premiums. Yet, it’s the confluence of factors like the high cost of roof replacements and the frequency of hail storms that dictate the premiums more than anything else.

Fort Worth residents renewing their policies in 2024 will feel the pinch of rate increases, reflecting the broader impact of higher replacement costs, inflation, and a state-wide premium hike due to weather-related damages. Insurers, wary of the increasing frequency and severity of events like the Texas heat wave, are tightening their belts, leading to stricter coverage rules and steeper premiums.

Understanding these costs is vital for homeowners, as it equips them with the knowledge to make informed decisions about their coverage. It ensures that when the skies darken and the winds pick up, the financial foundation of their homes remains as unshakeable as the resolve of the Texan spirit.

Maximizing Discounts and Savings on Homeowners Insurance

In the grand state of Texas, savvy homeowners know the value of a dollar and the importance of stretching it as far as possible, especially when it comes to insurance. Here are some tips to help you save money on your home insurance:

- Install safety features like smoke detectors or a security system to qualify for discounts.

- Regularly maintain your property to demonstrate its value and reduce the risk of damage.

- Personalize your belongings with identifying marks to deter theft and potentially lower your premiums.

By following these tips, you can make your home safer and your wallet heavier.

Some ways to save on insurance premiums include:

- Bundling policies, such as home and auto

- Choosing payment options like automatic payments or prepaying premiums

- Upgrading to impact-resistant roofing materials

- Being a seasoned resident or claim-free homeowner, which may make you eligible for premium discounts

These strategies can help you save money in the long run and protect your home against the elements.

Navigating Roofing Claims with Your Insurer

When the storm clouds gather and the rain starts to pound, knowing how to navigate roofing claims with your insurer can mean the difference between a seamless repair process and a financial headache. The path involves:

- Verifying coverage

- Involving a licensed roofing contractor

- Obtaining multiple estimates

- Working with insurance adjusters

- Providing thorough documentation

Each step is crucial in ensuring that when hailstones leave their mark, the claims process is as smooth as the calm after the storm.

Documentation and Evidence Collection

The aftermath of a storm in Fort Worth is not the time for tall tales; it’s a time for facts, supported by detailed documentation. After the winds die down, it is crucial to collect evidence of roof damage immediately. Involving a roofing contractor early to inspect and document the damage is like calling in the cavalry—it ensures that you have an expert’s eye on the situation.

The documentation must be as comprehensive as the Texas sky, with photographs and a detailed report that outlines the extent of the damage and the repairs needed. This not only aids in the accuracy of the roofing claim but also serves as undeniable proof to the insurance company, ensuring that your claim is taken as seriously as a Texas drought.

Working with Adjusters and Contractors

In the realm of roofing claims, adjusters and contractors play a crucial role, much like a rancher and his trusty foreman. After a major storm, construction costs can soar, which makes carrying enough insurance to cover these potential spikes as important as having a steady supply of water during a Texas heatwave. Homeowners should also be wary of contractors demanding payment upfront, as this can be a red flag for unreliable service.

Once a claim is in motion, an insurance adjuster rides in to independently assess the damage. It’s then that the adjuster should join forces with the homeowner’s chosen roofing contractor to ensure that repairs are properly facilitated and that the homestead is restored to its former glory. This collaboration is as essential as a well-oiled saddle, ensuring that both parties work together for the benefit of the home and its occupants.

Dispute Resolution and Advocacy

Navigating insurance claims can sometimes feel like trying to calm a wild bronco. It’s not uncommon for insurance companies to attribute roof damage to age rather than weather, but homeowners can challenge this by collecting robust evidence or getting an independent assessment. If the insurer remains as stubborn as a mule, legal aid in Fort Worth can step in, advocating for fair treatment and providing options like hiring independent adjusters or seeking legal assistance when necessary.

Should disputes arise, homeowners are not left out in the dust. They can take the following steps to address their concerns:

- File a formal written appeal with their insurer.

- Take their concerns to the Texas Department of Insurance if they suspect they’re getting the short end of the stick.

- Consider mediation as a peaceful path forward.

- If necessary, take legal action within two years from the date of the incident.

Supplemental Policies for Comprehensive Protection

The wide-open spaces of Texas are beautiful but can also be unforgiving, making supplemental policies a must for comprehensive protection. The Texas Windstorm Insurance Association (TWIA) steps in like a trusty sidekick when other insurers turn homeowners away, providing coverage for windstorm and hail damage. TWIA’s coverage is robust, but it requires compliance with building codes, and in some flood zones, proof of flood insurance—a smart move in a state where floods can arrive as swiftly as a summer storm.

Flood insurance is essential for Fort Worth’s residents, as standard home insurance policies typically don’t cover flood damage. Homeowners must look to the National Flood Insurance Program or private insurers like Chubb for separate policies to stay afloat financially if floodwaters rise. Chubb goes above and beyond, offering coverage for hurricanes and windstorms, and even a Property Manager service for seasonal homes—proving that sometimes, the extra mile is worth the journey for unparalleled peace of mind.

Another consideration for comprehensive coverage is sewer backup insurance. The damage caused by drain and sewer clogs can be as messy and costly as a mudslide after heavy rain, and standard home insurance policies usually don’t protect against this risk. Therefore, investing in supplemental sewer backup coverage can save homeowners from a potential financial quagmire.

Local Agent or Digital Insurance: Which Suits You Best?

In today’s digital age, Fort Worth homeowners face a modern-day crossroads: choosing between the traditional touch of a local agent or the sleek convenience of digital insurance. Digital insurance platforms are the new frontier, allowing policy management and claim filing anytime, anywhere, much like the 24/7 hustle of a cattle market. With the integration of AI, IoT, and Blockchain, these platforms provide real-time access to policy information, optimizing the insurance experience and allowing for a level of customer empowerment previously unseen.

The virtual world also tends to reduce overhead costs, leading to potential savings on premiums for policyholders—an attractive prospect as appealing as a sunset over the prairie. Artificial intelligence and predictive analytics enhance the capacity of digital insurance platforms to detect fraud, a modern-day equivalent of a sharp-eyed sheriff keeping the peace. The use of low-code platforms in digital insurance means capabilities can be quickly adapted or created, streamlining operations and ensuring the insurance process runs as smoothly as a well-tuned fiddle.

Yet, for some, the personal touch of a local agent is irreplaceable. These knowledgeable guides offer personalized advice and can help navigate the complexities of insurance coverage with the familiarity and comfort of a neighborly handshake. They can advocate for homeowners in ways that a digital platform may not, providing a sense of security as warm as a Texas welcome.

Ultimately, the choice between a local agent and digital insurance depends on individual preferences for convenience, cost, and personal service.

Fort Worth Specifics: Home Insurance Tailored to Texan Weather

Fort Worth’s vibrant character is matched only by the volatility of its weather, making tailored home insurance as essential as a good pair of cowboy boots. The city’s hot climate ushers in a variety of severe weather conditions, from hailstorms, aptly earning it the nickname ‘Hail Alley’, to the occasional tornado that can sweep through with little warning. Homeowners insurance policies in Fort Worth must be robust enough to cover the frequent hail and windstorms, ensuring effective management of roofing claims and peace of mind when the skies turn gray.

In addition to the hail and wind, Texans must also prepare for hurricanes and wildfires, both of which are prevalent causes of home insurance claims in the state. It’s not just about having insurance; it’s about having the right home insurance in Texas, tailored to the unique climate of Fort Worth and the greater Texas region. Homeowners need insurers that understand these local risks and provide comprehensive coverage that stands as strong as the Alamo against the elements.

Securing the right insurance in Fort Worth means being prepared for everything the Texas weather has to offer. It’s about ensuring that when the wind picks up and the hail starts to fall, your home remains a sanctuary, unscathed by the tempest outside.

Summary

Through the vast and varied landscape of Fort Worth’s homeowners insurance market, the journey can be daunting, but armed with the right information, it can also be rewarding. From identifying the best insurance companies to understanding the coverage you need, to navigating claims and seizing opportunities for savings, every step is part of the dance with the elements. Homeowners who are empowered with knowledge and the right coverage can rest easy, knowing their homestead is protected against whatever the Texas skies may bring. May your policy be as strong as your Texas pride, and may your home always be as welcoming as a Fort Worth sunset.

Frequently Asked Questions

What is the average homeowners insurance premium in Texas?

The average homeowners insurance premium in Texas is $2,959 per year, which is higher than the national average. It's crucial to find a policy that suits your specific needs and provides financial protection for your home and assets.

What is the most extensive home insurance policy?

The most extensive home insurance policy is an HO-5 policy, which provides comprehensive coverage for rebuilding your house and replacing personal belongings, excluding events like flood and earthquake damage.

Does the age of a roof affect homeowners insurance?

Yes, the age of your roof does affect your homeowners insurance. Insurance companies may not cover roofs older than 20 years and may require an inspection for older roofs before offering coverage.

What are key coverage features I should look for in a Fort Worth homeowners insurance policy?

When looking for a Fort Worth homeowners insurance policy, it's crucial to prioritize coverage for hail and windstorm damage, replacement cost coverage, and enhanced roofing materials coverage for comprehensive protection against local weather conditions.

Can I get discounts on my homeowners insurance in Fort Worth?

You can maximize discounts on your homeowners insurance in Fort Worth by installing safety features, performing regular property maintenance, and bundling policies. Being claim-free for several years or a senior citizen may also qualify you for additional discounts.

Guide To Find the Best Homeowners Insurance Policy for Fort Worth 2024: from a Seasoned Roofing Expert

With Fort Worth’s unpredictable weather, securing the best homeowners insurance policy for Fort Worth 2024 regarding roofing claims is crucial. Don’t get caught off-guard by costly damages. Our concise guide zeroes in on the best homeowners insurance policy options that deliver when you file a roofing claim in Fort Worth. We’ll highlight the insurers known for easy claims processing and robust coverage—valuable insights await for safeguarding your home.

Key Takeaways

- Homeowners in Fort Worth should prioritize robust insurance policies covering hail and windstorm damage due to the prevalence of extreme weather events, with the average annual wind and hail claim reaching around $12,000.

- Homeowners need to be aware of key coverage features, including the choice between replacement cost coverage and actual cash value, and consider supplemental policies such as those offered by the Texas Windstorm Insurance Association for comprehensive protection.

- When selecting a homeowners insurance policy, Fort Worth residents should consider factors like the insurer’s customer service reputation, claim resolution fairness, and customization options that fit unique needs, while also actively seeking out discounts to minimize premiums.

Fort Worth Roofing Claims: Homeowners Insurance Overview

If you’re planting your roots in Fort Worth, homeowners insurance is as essential as a sturdy pair of boots. The city’s penchant for extreme weather events, from hailstorms to tornadoes, leaves homeowners particularly vulnerable to high repair costs. It’s not just about having a policy; it’s about having the right coverage to ensure the homestead stands strong after a storm.

For Texas homeowners, the stakes are as high as the state’s famed sky. The average annual wind and hail claim can skyrocket to a staggering $12,000, a sum that can rattle any family’s financial foundation. Such figures underscore the importance of a robust insurance policy, safeguarding your investment from the unpredictable fury of Lone Star weather.

Many homeowners are bound by the requirements of mortgage lenders to maintain insurance, but even for those who own their homes outright, forgoing coverage is akin to playing roulette with your roof. In Fort Worth, insurance isn’t just a safety net; it’s a cornerstone of responsible home ownership.

Identifying Top Homeowners Insurance Companies in Texas

Navigating the sea of Texas homeowners insurance companies can be as challenging as corralling a herd of cattle. Yet, some insurers stand tall like beacons in the night, guiding homeowners to safe harbor. Among them, the top Texas homeowners insurance companies are:

- Chubb

- Lemonade

- Amica

- Texas Farm Bureau

These companies shine, thanks to their fair claims resolution and sterling communication.

These companies not only offer a variety of coverage options but also have a reputation for reliability, making them some of the best home insurance companies. In fact, one could argue that they are among the best homeowners insurance company options available. Some of the top home insurance companies for homeowners are:

- USAA: Offers replacement cost for personal belongings in its standard homeowners insurance policy and is a haven for veterans and service members.

- Nationwide: Known for additional coverages like water backup and identity theft at an extra cost.

- Farmers: Offers tiered plans to cater to homeowners at every level, ensuring there’s a policy to fit every homeowner’s unique needs.

When it comes to roofing claims, Amica and Texas Farm Bureau don’t just talk the talk; they walk the walk with excellent customer service and multiple policy discounts. And let’s not forget the value of a good ranking system, as devised by a local roofing expert, placing Chubb and Pure at the pinnacle for their supreme coverage limits and communication prowess. Below is how local roofing expert Sean Becker and his team ranked insurance carriers for 2024.

Pure: 9.9 in claims resolution

Chubb: 9.9 Super easy to work with and overly fair to customers

Amica: 9.9 is right up there with Pure and Chubb in fairness and speed to resolve claims. They are hands down the easiest to deal with and quickest to resolve claims, and not have the homeowner submit a million requests.

USAA: 9.5 has a long standing reputation of being fair and on the homeowners side

Texas Farm Bureau: 9.4 one of the biggest insurers of ranch properties. They take care of their customers!

Farmers: 9.3 During covid they allowed homeowner’s contractors to submit claim photos for almost instant claim payouts. We saw claims paid and an initial payment to the customer sometimes within 24 hrs from filing!

Nationwide: 9.3 They have awesome policies allowing customers to upgrade the roof, on each roof replacement claim. This makes the roof stronger and much less of a risk for the next storms!

Lemonade: 9.3 Easy to work with. Fast on the claims

Liberty Mutual: 9.0 Fast to cover damaged losses. They do not miss damage like the other big insurance carriers.

Safeco: 9.0 operates similarly to Liberty Mutual.

Are some of our favorite runner ups to the top three. These companies have been very stand up in the inspection side of claims. Calling damage, damage!

Essential Coverage Features for Fort Worth Residents

As Fort Worth residents well know, the right homeowners insurance policy must be as resilient as the city’s spirit. Key coverage features to look for include protection against hail and windstorm damage, the option for replacement cost coverage, and enhanced roofing materials coverage. Each component acts as another layer of protection against the financial impact of the city’s fierce weather, ensuring your home remains your stronghold.

Windstorm Insurance and Hail Protection

When the winds howl and hail pelts down like a scene from an old Western, standard homeowners insurance policies in Fort Worth typically offer sanctuary with coverage for wind and hail damage. Yet, there are times when the standard just won’t do, and a separate windstorm insurance policy becomes as necessary as a lasso for a cowboy. Such is the case when private insurers decline coverage, leaving homeowners to seek refuge with the Texas Windstorm Insurance Association (TWIA).

Financial protection against these calamities is not to be taken lightly. Consider TGS Insurance Agency’s approach, which includes a 2% hail/wind deductible in every policy, translating to a $5,000 responsibility for homeowners on a $250,000 dwelling coverage in the event of a claim. This makes the right insurance coverage not just a choice, but a financial imperative for Fort Worth residents.

USAA stands as a beacon for those in the path of windstorms and hurricanes, offering specialized insurance in its standard policies, ideal for those who may face the wrath of such weather events. It’s a testament to the value of choosing a homeowners insurance company that understands the unique challenges posed by the Texas climate.

Replacement Cost vs. Actual Cash Value

When misfortune strikes and damages your homestead, the method of compensation can make all the difference. Replacement cost coverage is the ultimate defender, offering to rebuild your home with like kind and quality materials without factoring in depreciation. Actual cash value, on the other hand, is the shrewd accountant, paying out the market value of your property at the time of damage, minus depreciation.

The choice between these two is not just about coverage—it’s about peace of mind. Replacement cost coverage might carry higher premiums, but it ensures that the heart of your home—its roof—can be restored to its former glory without the worry of depreciation. It’s a premium worth paying for those who wish to stand firm against the tests of time and nature.

Fort Worth homeowners must carefully consider their financial situation when choosing between these two options. Insurance companies have a duty to make clear how depreciation will affect claim payouts, whether the policy offers recoverable or non-recoverable depreciation, and how this will influence the outcome of roofing claims. For full recovery of depreciation, repairs must be completed within specified timeframes, making the decision all the more critical.

Enhanced Roofing Materials Coverage

In the quest for the ultimate roof over one’s head, enhanced roofing materials coverage emerges as a lighthouse guiding ships through a storm. Nationwide’s Better Roof Replacement allows homeowners to upgrade to stronger materials, fortifying their homes against future onslaughts. Similarly, Liberty Mutual rewards those who choose impact-resistant materials with discounts, paving the way for long-term savings and improved protection.

Having a roof that can stand up to Fort Worth’s punishing weather not only provides peace of mind but also financial perks. Upgrading to impact-resistant or noncombustible materials can lead to insurance discounts, underscoring the tangible benefits of investing in your home’s first line of defense. Moreover, warranties like the GAF Golden Pledge provide an ironclad promise of quality, covering manufacturing defects for up to 50 years and installation errors for up to 30 years.

The role of a reputable roofing contractor includes:

- Bringing expertise in selecting the right shingle brands and recommending the best materials

- Enhancing your roof and bolstering your position when dealing with insurance claims

- Ensuring that the warranties provided, which typically cover tear-off and disposal costs, add an extra layer of protection for homeowners, even if the original contractor is no longer in business.

How to Find the Best Insurance Company for Your Needs

The journey to find the best home insurance company in Fort Worth is not unlike navigating the Trinity River—twists and turns abound, but the right guide can lead you to calm waters. The beacon of excellent customer service should always guide your way, coupled with adherence to Texas Department of Insurance guidelines to ensure fair treatment during claims assessments and payments.

Customization in your policy is akin to tailoring a fine suit—it must fit your unique needs perfectly. Seek out insurers that offer flexibility and coverage options that can be tailored to your specific situation, such as identity theft protection or varying levels of depreciation. And remember, comparing multiple insurance options is as essential as a cowboy’s comparison of boots before a purchase. Shop around, get quotes, and understand the optional coverages and discounts offered by different insurers in the Lone Star State. You may need to invest some time in this process, but it will be worth it in the end.

Additional features such as clear guidelines on ALE and a fair appraisal process sweeten the deal. Personalized assistance from independent agents or expert advice can help you navigate the complexities of insurance, ensuring you’re as well-equipped as a Fort Worth cowboy at the rodeo.

Understanding Homeowners Insurance Costs in Fort Worth

The cost of homeowners insurance in Fort Worth is as varied as the Texas landscape. On average, Texas homeowners insurance rates can be around $2,090 per year for $250,000 of dwelling coverage, with some companies like Farmers offering more wallet-friendly premiums. Yet, it’s the confluence of factors like the high cost of roof replacements and the frequency of hail storms that dictate the premiums more than anything else.

Fort Worth residents renewing their policies in 2024 will feel the pinch of rate increases, reflecting the broader impact of higher replacement costs, inflation, and a state-wide premium hike due to weather-related damages. Insurers, wary of the increasing frequency and severity of events like the Texas heat wave, are tightening their belts, leading to stricter coverage rules and steeper premiums.

Understanding these costs is vital for homeowners, as it equips them with the knowledge to make informed decisions about their coverage. It ensures that when the skies darken and the winds pick up, the financial foundation of their homes remains as unshakeable as the resolve of the Texan spirit.

Maximizing Discounts and Savings on Homeowners Insurance

In the grand state of Texas, savvy homeowners know the value of a dollar and the importance of stretching it as far as possible, especially when it comes to insurance. Here are some tips to help you save money on your home insurance:

- Install safety features like smoke detectors or a security system to qualify for discounts.

- Regularly maintain your property to demonstrate its value and reduce the risk of damage.

- Personalize your belongings with identifying marks to deter theft and potentially lower your premiums.

By following these tips, you can make your home safer and your wallet heavier.

Some ways to save on insurance premiums include:

- Bundling policies, such as home and auto

- Choosing payment options like automatic payments or prepaying premiums

- Upgrading to impact-resistant roofing materials

- Being a seasoned resident or claim-free homeowner, which may make you eligible for premium discounts

These strategies can help you save money in the long run and protect your home against the elements.

Navigating Roofing Claims with Your Insurer

When the storm clouds gather and the rain starts to pound, knowing how to navigate roofing claims with your insurer can mean the difference between a seamless repair process and a financial headache. The path involves:

- Verifying coverage

- Involving a licensed roofing contractor

- Obtaining multiple estimates

- Working with insurance adjusters

- Providing thorough documentation

Each step is crucial in ensuring that when hailstones leave their mark, the claims process is as smooth as the calm after the storm.

Documentation and Evidence Collection

The aftermath of a storm in Fort Worth is not the time for tall tales; it’s a time for facts, supported by detailed documentation. After the winds die down, it is crucial to collect evidence of roof damage immediately. Involving a roofing contractor early to inspect and document the damage is like calling in the cavalry—it ensures that you have an expert’s eye on the situation.

The documentation must be as comprehensive as the Texas sky, with photographs and a detailed report that outlines the extent of the damage and the repairs needed. This not only aids in the accuracy of the roofing claim but also serves as undeniable proof to the insurance company, ensuring that your claim is taken as seriously as a Texas drought.

Working with Adjusters and Contractors

In the realm of roofing claims, adjusters and contractors play a crucial role, much like a rancher and his trusty foreman. After a major storm, construction costs can soar, which makes carrying enough insurance to cover these potential spikes as important as having a steady supply of water during a Texas heatwave. Homeowners should also be wary of contractors demanding payment upfront, as this can be a red flag for unreliable service.

Once a claim is in motion, an insurance adjuster rides in to independently assess the damage. It’s then that the adjuster should join forces with the homeowner’s chosen roofing contractor to ensure that repairs are properly facilitated and that the homestead is restored to its former glory. This collaboration is as essential as a well-oiled saddle, ensuring that both parties work together for the benefit of the home and its occupants.

Dispute Resolution and Advocacy

Navigating insurance claims can sometimes feel like trying to calm a wild bronco. It’s not uncommon for insurance companies to attribute roof damage to age rather than weather, but homeowners can challenge this by collecting robust evidence or getting an independent assessment. If the insurer remains as stubborn as a mule, legal aid in Fort Worth can step in, advocating for fair treatment and providing options like hiring independent adjusters or seeking legal assistance when necessary.

Should disputes arise, homeowners are not left out in the dust. They can take the following steps to address their concerns:

- File a formal written appeal with their insurer.

- Take their concerns to the Texas Department of Insurance if they suspect they’re getting the short end of the stick.

- Consider mediation as a peaceful path forward.

- If necessary, take legal action within two years from the date of the incident.

Supplemental Policies for Comprehensive Protection

The wide-open spaces of Texas are beautiful but can also be unforgiving, making supplemental policies a must for comprehensive protection. The Texas Windstorm Insurance Association (TWIA) steps in like a trusty sidekick when other insurers turn homeowners away, providing coverage for windstorm and hail damage. TWIA’s coverage is robust, but it requires compliance with building codes, and in some flood zones, proof of flood insurance—a smart move in a state where floods can arrive as swiftly as a summer storm.

Flood insurance is essential for Fort Worth’s residents, as standard home insurance policies typically don’t cover flood damage. Homeowners must look to the National Flood Insurance Program or private insurers like Chubb for separate policies to stay afloat financially if floodwaters rise. Chubb goes above and beyond, offering coverage for hurricanes and windstorms, and even a Property Manager service for seasonal homes—proving that sometimes, the extra mile is worth the journey for unparalleled peace of mind.

Another consideration for comprehensive coverage is sewer backup insurance. The damage caused by drain and sewer clogs can be as messy and costly as a mudslide after heavy rain, and standard home insurance policies usually don’t protect against this risk. Therefore, investing in supplemental sewer backup coverage can save homeowners from a potential financial quagmire.

Local Agent or Digital Insurance: Which Suits You Best?

In today’s digital age, Fort Worth homeowners face a modern-day crossroads: choosing between the traditional touch of a local agent or the sleek convenience of digital insurance. Digital insurance platforms are the new frontier, allowing policy management and claim filing anytime, anywhere, much like the 24/7 hustle of a cattle market. With the integration of AI, IoT, and Blockchain, these platforms provide real-time access to policy information, optimizing the insurance experience and allowing for a level of customer empowerment previously unseen.

The virtual world also tends to reduce overhead costs, leading to potential savings on premiums for policyholders—an attractive prospect as appealing as a sunset over the prairie. Artificial intelligence and predictive analytics enhance the capacity of digital insurance platforms to detect fraud, a modern-day equivalent of a sharp-eyed sheriff keeping the peace. The use of low-code platforms in digital insurance means capabilities can be quickly adapted or created, streamlining operations and ensuring the insurance process runs as smoothly as a well-tuned fiddle.

Yet, for some, the personal touch of a local agent is irreplaceable. These knowledgeable guides offer personalized advice and can help navigate the complexities of insurance coverage with the familiarity and comfort of a neighborly handshake. They can advocate for homeowners in ways that a digital platform may not, providing a sense of security as warm as a Texas welcome.

Ultimately, the choice between a local agent and digital insurance depends on individual preferences for convenience, cost, and personal service.

Fort Worth Specifics: Home Insurance Tailored to Texan Weather

Fort Worth’s vibrant character is matched only by the volatility of its weather, making tailored home insurance as essential as a good pair of cowboy boots. The city’s hot climate ushers in a variety of severe weather conditions, from hailstorms, aptly earning it the nickname ‘Hail Alley’, to the occasional tornado that can sweep through with little warning. Homeowners insurance policies in Fort Worth must be robust enough to cover the frequent hail and windstorms, ensuring effective management of roofing claims and peace of mind when the skies turn gray.

In addition to the hail and wind, Texans must also prepare for hurricanes and wildfires, both of which are prevalent causes of home insurance claims in the state. It’s not just about having insurance; it’s about having the right home insurance in Texas, tailored to the unique climate of Fort Worth and the greater Texas region. Homeowners need insurers that understand these local risks and provide comprehensive coverage that stands as strong as the Alamo against the elements.

Securing the right insurance in Fort Worth means being prepared for everything the Texas weather has to offer. It’s about ensuring that when the wind picks up and the hail starts to fall, your home remains a sanctuary, unscathed by the tempest outside.

Summary

Through the vast and varied landscape of Fort Worth’s homeowners insurance market, the journey can be daunting, but armed with the right information, it can also be rewarding. From identifying the best insurance companies to understanding the coverage you need, to navigating claims and seizing opportunities for savings, every step is part of the dance with the elements. Homeowners who are empowered with knowledge and the right coverage can rest easy, knowing their homestead is protected against whatever the Texas skies may bring. May your policy be as strong as your Texas pride, and may your home always be as welcoming as a Fort Worth sunset.

Frequently Asked Questions

What is the average homeowners insurance premium in Texas?

The average homeowners insurance premium in Texas is $2,959 per year, which is higher than the national average. It's crucial to find a policy that suits your specific needs and provides financial protection for your home and assets.

What is the most extensive home insurance policy?

The most extensive home insurance policy is an HO-5 policy, which provides comprehensive coverage for rebuilding your house and replacing personal belongings, excluding events like flood and earthquake damage.

Does the age of a roof affect homeowners insurance?

Yes, the age of your roof does affect your homeowners insurance. Insurance companies may not cover roofs older than 20 years and may require an inspection for older roofs before offering coverage.

What are key coverage features I should look for in a Fort Worth homeowners insurance policy?

When looking for a Fort Worth homeowners insurance policy, it's crucial to prioritize coverage for hail and windstorm damage, replacement cost coverage, and enhanced roofing materials coverage for comprehensive protection against local weather conditions.

Can I get discounts on my homeowners insurance in Fort Worth?

You can maximize discounts on your homeowners insurance in Fort Worth by installing safety features, performing regular property maintenance, and bundling policies. Being claim-free for several years or a senior citizen may also qualify you for additional discounts.

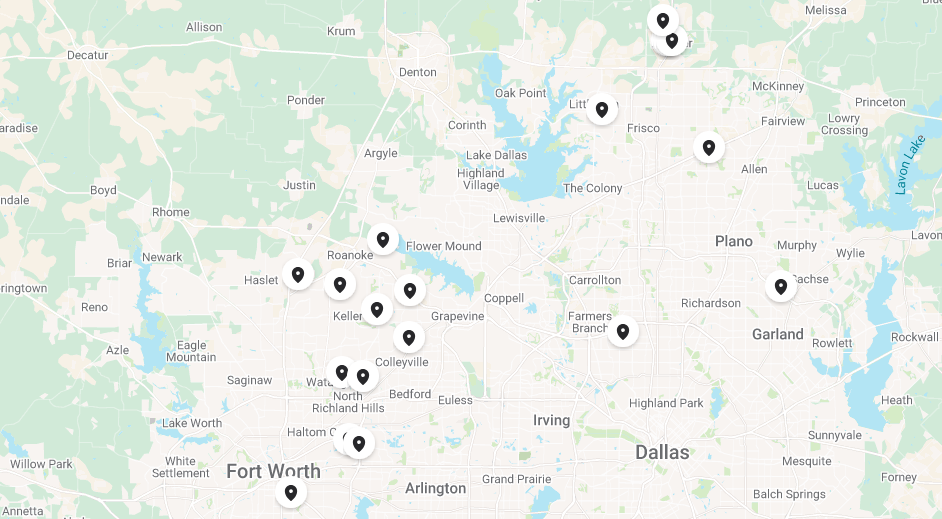

Our Location

Hours

Hours

Contact Us

License # 03-0235